Welcome to the latest edition of Gilmartin Group’s ESG newsletter. With a special focus on the healthcare sector, this newsletter sheds light on the latest trends in the rapidly evolving ESG space, covering developments with companies, investors, regulators, and policymakers.

IN THE SPOTLIGHT

Over the past few years, ESG has grown increasingly mainstream within the investment world. Sustainable funds in the U.S. attracted record amounts of asset flows in 2021. However, ESG investing is presently hitting the next phase of its evolution amidst not only a broader market decline, but also increased scrutiny on the investment industry’s approach to, and application of, ESG principles.

On the buy side, ESG-focused asset managers are getting more pressure from clients and regulators to demonstrate the results of their strategies. In June, the SEC launched a probe to investigate Goldman Sachs Asset Management’s ESG funds. In May, German authorities raided the Frankfurt offices of Deutsche Bank’s asset management arm in response to greenwashing allegations.

Elon Musk is among a growing number of ESG critics who have emerged in recent months, pushing back against ESG ratings and indices. Musk unleashed a viral diatribe after S&P Dow Jones Indices announced Tesla has been removed from the popular S&P 500 ESG Index. Although S&P acknowledged Tesla’s mission to accelerate electric vehicle adoption and the energy transition, the firm said that Tesla has “fallen behind its peers when examined through a wider ESG lens.” For example, S&P pointed to the company’s handling of racial discrimination and workplace safety incidents as events that had a negative effect on Tesla’s S&P ESG score.

In our view, the apparent backlash against ESG underscores a misperception that ESG ratings provide some type of binary assessment of whether a company is “good” or “bad.” Rather, ESG should be thought of as a framework to assist in understanding and assessing how companies are managing a broad range of environmental, social, and governance topics, and ESG ratings are merely one tool used to capture data and provide analysis.

A LOOK INTO ESG RATINGS

GreenBiz Group’s Joel Makower wrote an excellent three-part series dissecting ESG ratings and exploring the recent pushback in depth. In an interview for the series, Jefferies’ Global Head of ESG, Aniket Shah, said, “The end goal of all of us who had entered the space was to integrate these ideas into our regulation, into our risk assessment and into the way we think about future opportunities of companies. We are getting close to that because the disclosures are getting better, thanks to the ESG movement.” Although ESG rating methodologies are being scrutinized today, Shah predicts that ESG “ceases to be a standalone concept in 2024” and perhaps even sooner.

We believe the confusion over ESG assessment criteria reveals the need for more standardization, and efforts on this front are already well underway. We consistently advise companies to focus their efforts on being the source of truth for ESG data they believe to be relevant to their business, rather than simply chasing improved scores from ESG ratings firms. By building trust with stakeholders through transparent and accurate reporting on ESG topics, we believe rating improvements will be a natural outcome over time.

THE HEALTHCARE VIEW

Abbott Laboratories’ baby formula recall, which wreaked havoc on the supply of baby formula in the U.S., highlights the importance of product quality and safety as an ESG issue. Product quality and safety consistently ranks as one of the most significant ESG issues for healthcare companies. According to the Sustainability Accounting Standards Board materiality map, product quality and safety is the only topic considered to be material for every sub-sector within the healthcare industry. In particular, product recalls are one of the foremost ESG risks that healthcare companies face. While the fallout from Abbott’s baby formula recall is in the headlines, prominent ESG ratings firm MSCI noted that Abbott has had to recall 340 products since 2011 and, according to MSCI’s assessment, is engaged in six ongoing controversies related to product quality and safety. The recent baby formula recall also accentuated other ESG topics for Abbott, such as supply chain management, regulatory compliance, and product access and affordability. The Abbott recall should serve as a reminder for healthcare companies that product quality and safety issues can have wide-ranging effects on how a company is perceived from an ESG perspective.

IN THE WEEDS

In May, the International Sustainability Standards Board (ISSB) announced that it is coordinating with the Integrated Reporting Framework to encourage companies to combine sustainability disclosures with their financial reports. ISSB aims to make sustainability information more comparable and consistent by developing industry-specific reporting standards by the end of 2022. By incorporating the Integrated Reporting Framework into its standard setting project, ISSB will encourage companies to place sustainability information in their quarterly and annual financial reports, as opposed to standalone sustainability reports that are more common among public companies.

[/fusion_text][fusion_title title_type=”text” rotation_effect=”bounceIn” display_time=”1200″ highlight_effect=”circle” loop_animation=”off” highlight_width=”9″ highlight_top_margin=”0″ hide_on_mobile=”small-visibility,medium-visibility,large-visibility” sticky_display=”normal,sticky” content_align=”left” size=”1″ font_size=”32px” text_shadow=”no” text_shadow_blur=”0″ margin_top=”20px” margin_bottom=”10px” text_color=”#083c4c” style_type=”default” animation_direction=”left” animation_speed=”0.3″]

A NOTE ON ESG INVESTING

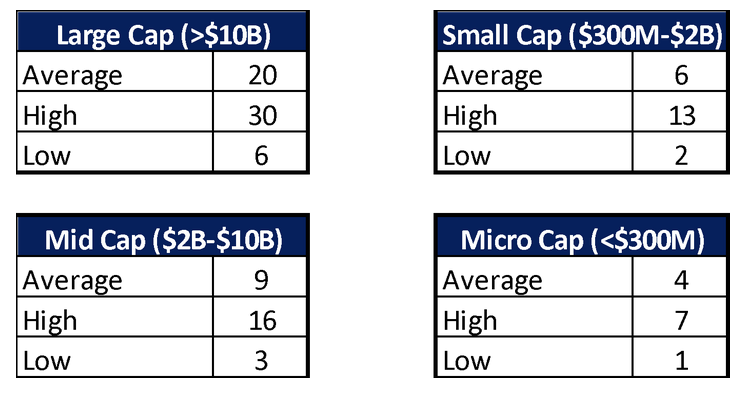

Recognizing that ESG adoption has been slow among small cap companies, Franklin Templeton argued in a recent thought leadership piece that investors have a unique opportunity to positively influence small cap company ESG practices. ESG disclosure among small caps is lacking because they generally have fewer resources to dedicate to ESG practices and reporting than larger companies, and small caps often receive lower ESG scores because of this relative lack of disclosure. Noting that a company’s ESG practices are intrinsically linked to long-term performance, Franklin Templeton believes that ESG-focused small cap investors may have an opportunity to create additional shareholder value by actively engaging with small caps to improve their ESG performance and policies.

ONE BIG THING

In an effort to combat greenwashing, the SEC proposed a new set of rules in May that target ESG investment practices. To crack down on misleading claims by some funds about how ESG is integrated in their investment processes, one proposal aims to enhance the Names Rule so that funds with ESG labels would be required to define their ESG investment strategy and allocate 80% of their assets in-line with that strategy. The other proposal aims to categorize various ESG investment strategies and require funds following these strategies to make specific disclosures. For example, funds that have an environmental focus would be required to calculate and disclose the greenhouse gas emissions associated with their portfolio.

The SEC’s latest proposals come as companies continue to digest the potential compliance implications of the climate disclosure rules that were floated in March. Although eight countries, including the U.K. and France, have already implemented similar disclosure rules for public companies, a number of U.S. companies are pushing back on the SEC’s proposal. The Business Roundtable, whose members include the CEOs of large U.S. companies, published a comment letter urging major revisions to the proposal, stating that some of the requirements are overly burdensome and would increase liability for companies. BlackRock and Nasdaq also published comment letters urging the SEC to issue more flexible “comply or explain” disclosure rules, particularly for Scope 3 emissions calculations.

QUESTIONS ON ESG?

Our dedicated ESG team has deep institutional knowledge and experience in ESG and healthcare, enabling us to assess, inform, and guide healthcare companies at every stage of their ESG journeys. If you are interested in learning more about how to navigate your own internal ESG policies, practices, data, and disclosures, feel free to contact our team today.

MATT BERNER

Managing Director, Head of ESG

PATRICK SMITH

Analyst, ESG