Market volatility in the biotech sector is likely a product of macroeconomic headwinds

The biotech capital markets came in hot to kickstart 2024 with 6 IPOs listed on NASDAQ or NYSE in the months of January and February. However, investor optimism started to dissipate as the momentum faded, with only 3 additional biotech IPOs since February. It will likely be some time for market conditions to stabilize after the post-COVID surge of 100+ biotech IPOs, raising a total of $15 billion in 2021. Today’s market conditions have yielded some biotechs withdrawing their IPOs from the stock exchanges last minute. It’s no surprise that the majority of biotech IPOs in 2024 are trading below their initial offering price, aside from select market outperformers such as CG Oncology, Contineum, and Rapport.

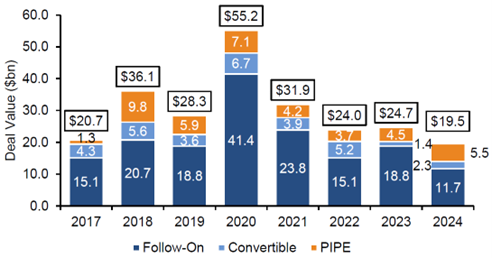

While there may be sector specific factors leading to heightened market volatility, much of the unpredictability is a product of the macroeconomic headwinds of the Fed’s restrictive monetary policy, geopolitical tensions, and a major presidential election looming around the corner. As fresh powder is drying up, companies are now starting to tap into alternative methods of financing. According to data from Evercore, U.S. biotechs have raised $5.5 billion through private investment in public equity deals, commonly known as PIPEs, in 2024.

Source: Evercore

The return of the PIPE transaction in 2024

A PIPE is a private placement transaction in which accredited investors buy publicly traded shares at a price that is often discounted to the current market price in exchange for illiquid shares. Companies are required to register the shares from the PIPE through filling a resale registration statement usually within 30-60 days of the offering. The transaction is more efficient and has a lower fee compared to registered offerings. This is a result of the lower regulatory burden with the Securities and Exchange Commission (SEC) since the shares issued do not need to be registered immediately.

These accredited investors often include institutional investors such as hedge funds, pension funds and specialist investors. Historically, PIPEs have been limited to distressed companies that have run out of options and need capital to stay afloat. However, the PIPEs of 2024 have returned with a different flavor with many pricing at a premium to market price, stemming from strong investor demand, often based on positive clinical trial results.

“PIPEs go against the spirit of the capital markets” – Undisclosed investor

While PIPEs have gained popularity among some biotech investors, the investment community is divided on this ethical dilemma. The process of a PIPE transaction involves a public company engaging a placement agent or investment banker who will identify, and wall cross select accredited investors to share non-public information, often consisting of an early look at clinical trial results. This poses a controversial question keeping some of us awake at night: “is inequity of access fair?” Why are select investors able to participate in these transactions while others are left on the sidelines?

Some investors reason that it’s unfair to offer highly coveted non-public information to select individuals, as this results in unequal access to privileged information when making important investment decisions. In certain cases, existing shareholders don’t even have the opportunity to participate in the deal. Critics of this financing strategy say that these kinds of transactions hurt the biotech sector because the unlevel playing field that it cultivates goes against the spirit of the stock market.

By that logic, the same could be said for any confidentially marketed deal, such as a registered direct offering or confidentially marketed public offering (CMPO). All of these options provide select individuals an early look at data and an upper hand over those who did not make it across the wall. Where PIPEs differ from other confidentially marketed deals is that only a select couple dozen specialist biotech investors end up controlling the majority of the deal flow in the sector.

PIPEs attract specialist investors to a company’s shareholder base and potentially result in open market buying

PIPEs provide an avenue to the cap table for funds that may not have otherwise invested in the company due to liquidity constraints associated with open market buying. Often times, these are specialist biotech investors that truly understand the value of the data and are looking to take large positions. Adding this type of diversification to the company’s shareholder base gives the rest of the investment community conviction to potentially buy the stock in the open market. I emphasize potentially as the market reaction is tough to predict and it can be a challenge to differentiate if third-party validation or the concurrently announced positive data was the market mover.

PIPEs mitigate market risk in the face of uncertainty

One of the biggest challenges with data driven catalysts is that the stock market does not have a logical flow. Even when companies release clean data which many would determine is universally positive, the hamster wheel of emotion of the capital markets has a mind of its own.

The strategic advantage of completing a PIPE transaction is that market risk is mitigated along with any financing overhang. For companies that have more complex data, generalist and retail investors will need more time to digest their stories. During a PIPE, specialist investors conduct extended diligence on the deal, and their participation serves as external validation prior to exposure to the market. This attenuates the risk of data getting lost in muddy waters and gives companies who may have otherwise not have been able to move forward a fighting chance.

Does information asymmetry facilitate market manipulation?

There has been controversy over the years around PIPEs facilitating the grounds for market manipulation. In April 2024, the controversy took the spotlight when an investor sued Taysha Gene Therapies for insider trading. The lawsuit claimed that company insiders manipulated the timing of positive data disclosures for a drug used to treat Rett syndrome. This was timed with a PIPE deal that took place in August 2023 resulting in a quadrupling of the stock price and $205 million in immediate gains.

Events like this have led PIPEs to be under high scrutiny by the SEC. There have been cases of hedge funds violating U.S. federal securities laws by participating in a PIPE deal to cover shares the fund shorted in anticipation of the PIPE offering. Another phenomenon known as “shadow insider trading” occurs when investors who have been wall crossed use that information to make an investment in competitor companies.

In the biotech sector, data will always be king (or queen)

Whether it be alternative or conventional equity-raising methods, data is the only thing in the biotech industry that provides optionality for raising capital. Now more than ever we are seeing a drop in opportunistic financings as investors allocate their resources towards catalyst driven deals. Every company is different, and the strength of the data is paramount to understating what method of financing is most suitable.

For example, if a company has grand slam data, a PIPE transaction may limit potential upside in valuation. In a PIPE, companies are providing investors with a free call option and stock at a discount. On the other end of the spectrum is a publicly marketed deal where the company announces the proposed public offering concurrent with the data. This provides an opportunity for the market to react positively, the share price to shoot up and the potential to raise capital at a higher stock price with less dilution. Viking Therapeutics and Vaxcyte’s latest deals this year are prime examples of this financing strategy.

While it’s impossible to predict how the market will react to data, the level of conviction that management teams have on the strength of their data will guide their risk tolerance in the capital markets. The key is mapping out scenarios to provide optionality for different financing strategies and maintaining agility throughout the process. All biotech companies are in a perpetual state of fundraising and its never too early to start planning your next financing.

Gilmartin Group has extensive experience working with both private and public companies across the biotech space. To find out more about how we strategically partner with our clients, please contact our team today.

Authored by: Kiki Patel, Principal, Gilmartin Group