Since January 2019, there have been about 15 US-listed SPAC IPOs compared to about 270 traditional IPOs. In our two-part series, we will explain the recent interest in SPACs and investor relations process and considerations. In Part I, we will cover how SPACs work and key transaction considerations. In Part II of our series, we will describe the investor relations approach in more detail.

What is a Special Purpose Acquisition Company (SPAC)?

Also known as “blank check companies,” a SPAC, is a company with no commercial operations that is formed strictly to raise capital through an Initial Public Offering (IPO) for the purpose of acquiring an existing company. SPACs are an alternative for private companies looking to become publicly traded by way of the SPAC “acquiring” or “merging” with a privately held company.

With the SPAC already listed on the exchanges as a public company, a significant amount of time can be saved in the capital formation process, with SPAC mergers potentially being completed in as little as 45 days. SPACs typically have one or two “anchor” shareholders with a limited number of initial investors. SPAC founders and large investors typically negotiate financing terms with the private company and become shareholders, sometimes significant, of the private company following the closing of the merger transaction.

How a SPAC Works

Special purpose acquisition companies are initially formed by a group of investors or sponsors with the intention of pursuing an acquisition within a specific industry or with a targeted financial profile. Due to the lack of specific target at IPO, SPACs are often referred to as “blank check companies” with SPAC IPO investors relying on the pedigree and operating history of the SPAC leadership to identify and consummate a transaction. In return for committing capital and time to a SPAC, initial investors and management typically receive some type of warrant, or financing commitment, at terms comparable to the SPAC IPO price. This creates incentive for the management team to execute a transaction at a value creating level above the SPAC IPO price.

Sponsors first raise capital through the IPO process which is then placed in a trust. This capital cannot be distributed unless the SPAC has entered into an M&A transaction. Following announcement of the transaction, the two companies work together to finalize merger terms and address regulatory filing requirements. During this period, investors, and the market may support the proposed merger and value of the combined company at a premium to the SPAC $10 IPO price. As closing of the merger becomes more certain, the market will start to trade the SPAC based upon the post-merger value of the company, often in-excess of the $10 SPAC standalone value.

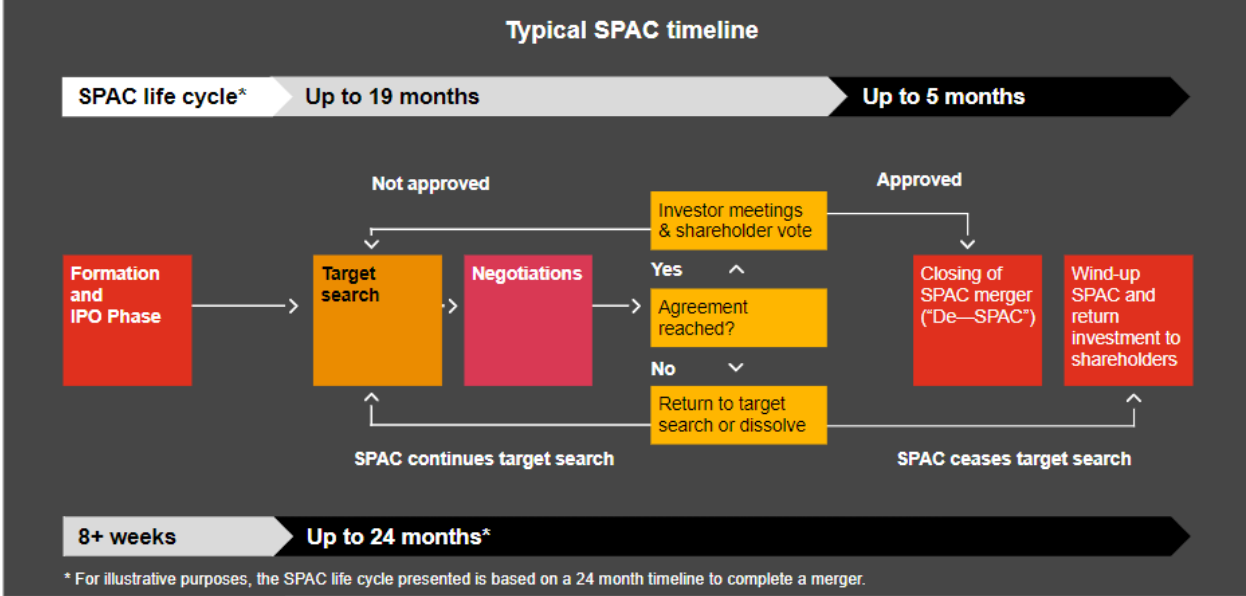

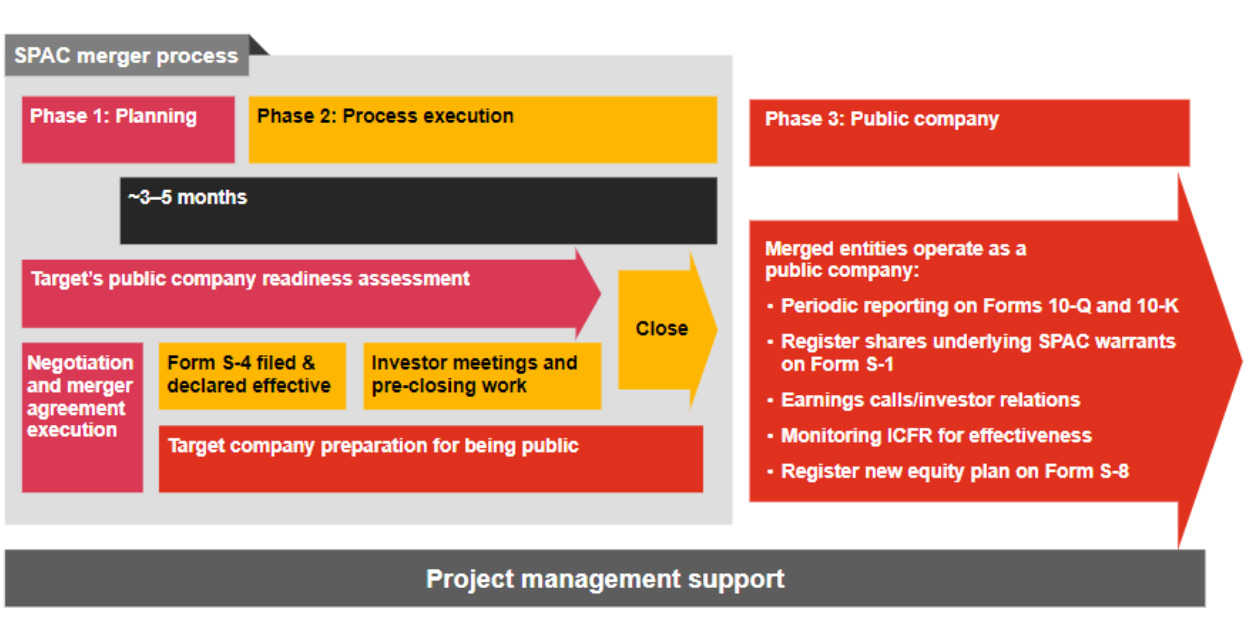

To illustrate, PriceWaterhouseCoopers recently published an article with the following infographics, which outline the dynamics mentioned above.

In the event the SPAC is unable to find and negotiate a successful transaction, at the end of the predetermined time period, the funds in Trust are redistributed back to the initial investors. SPACs generally have a two-year window to complete an acquisition before they have to liquidate and return the capital.

Why Go Public Through a SPAC

This expedited IPO process is attractive to many companies as it avoids the time consuming and expensive process of raising capital by way of an IPO. By being acquired by a SPAC, a private company can reduce uncertainty surrounding the pricing of a deal and close in a fraction of the time a normal IPO would take. A private company can move through the SPAC business combination process in as little as 2 months whereas a traditional IPO can take upwards of 9-12 months.

In uncertain and volatile times, such as the COVID-19 pandemic, executing the traditional IPO process may subject private companies to unfavorable market conditions, resulting in lower pricing of the IPO and less capital raised. SPACs, however, have already raised the necessary capital and often have access to additional capital (by way of the warrants and other equity), and the SPAC process may be less exposed to overall investor sentiment and market conditions.

Additionally, a private company looking to go public may be hoping to raise a small amount of capital, and they may not attract the interest of traditional investment banks who facilitate IPOs. Early stage biopharma companies, for instance, may not qualify for an IPO but believe the growth potential of their research warrants access to the public markets. In pursuing a public listing by way of a SPAC, such companies would benefit from the SPAC’s structure, and they could bypass the IPO process while becoming public quickly and eliminating certain IPO preparation costs, thereby preserving existing capital.

SPAC Transaction Considerations

If you are considering going public through a merger with a SPAC, there are several considerations that need to be thoroughly vetted prior to the merger. Below we have provided some key questions to consider:

- Who are the shareholders and sponsors in the current SPAC?

- Are the SPAC sponsors planning an exit from the investment?

- What are your absolute working capital needs for the business and is a SPAC sufficient?

- Will a Private Investment in Public Equity (PIPE) need be completed in conjunction with the transaction?

- How is the public company planning to obtain equity research coverage?

- If sell-side research coverage is not a priority, how does the company plan to run its investor relations program and garner interest from asset managers and hedge funds?

Completing a transaction with a reputable SPAC sponsor can ultimately be the deciding factor in ensuring a company’s public debut is a success. Additionally, it is not uncommon for SPAC sponsors to retain a board seat at the post-merger company. Therefore, it is very important to consider which investors are involved in the SPAC in addition to potential PIPE investors.

Conclusion

A special purpose acquisition company may serve as a suitable alternative to traditional IPOs when time, capital, or market conditions are more constrained. In recent years, SPACs have become more prevalent in the markets as companies are seeking speedier methods of going public while also obtaining capital to support the business. Companies should consider both the opportunities and trade-offs associated with SPACs and the implications a SPAC transaction will have on the business becoming a public entity.

If you’re considering a SPAC transaction or would like more information on implementing an investor relations strategy for an upcoming SPAC transaction, contact us today.

David Deuchler, Managing Director and Collin Beloin, Associate

Leave a Reply