Retail Momentum

Market participant demographics are changing as new brokerage platforms like Robinhood, which offers convenient mobile apps and low commission trading, continue to attract the next generation of investors. This group is more engaged across social media, where “influencers” have demonstrated the ability to incite herd mentality trades that can generate meaningful momentum and drive significant stock price movements. Reddit’s r/wallstreetbets was most recently cited by financial media as the source for the violent short squeeze in GameStop. Monitoring social media, both what investors and companies are saying, is now an important component of a comprehensive investor relations program.

Equity Financings

As public equity valuations continue their climb to new all time highs, evoking memories of the most historic bull markets, many are shifting their corporate timelines because this may be an opportune time for companies to finance with minimally dilutive equity. With low interest rates and a Fed that has vowed to keep rates low to help the economy though the pandemic, investors have shown a near insatiable appetite for follow-on offerings and new issues alike.

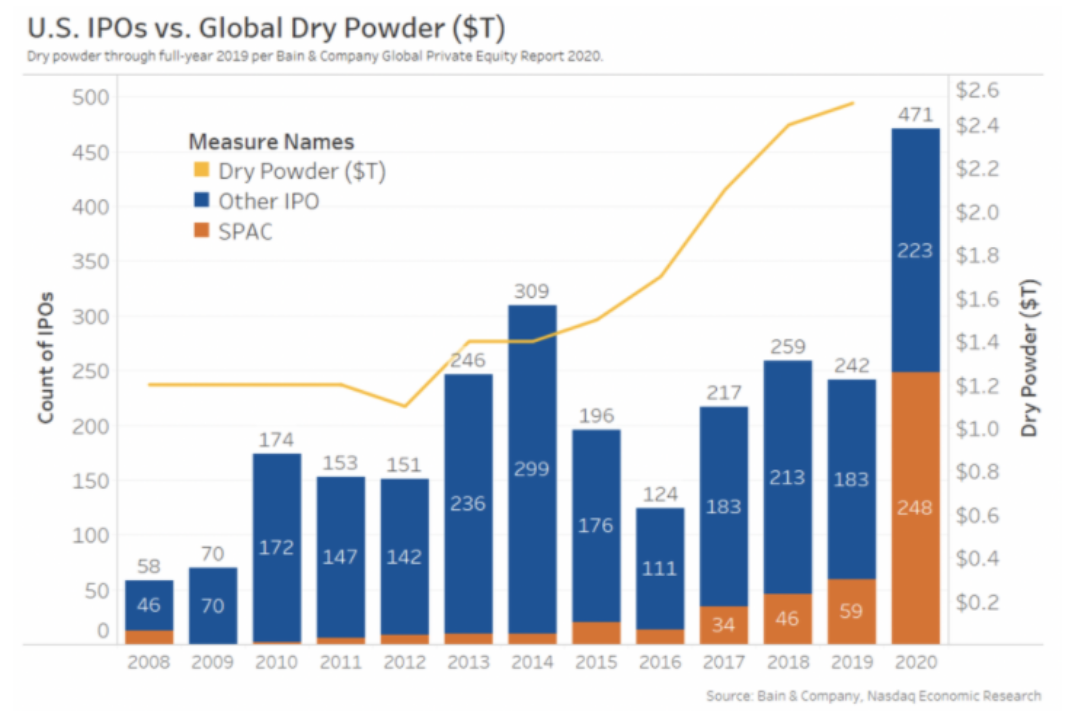

SPACs

The percent of capital raised in IPOs for SPACs is accelerating significantly. According to Dealogic, in 2019 it was around 20%, in 2020 it was just under 50%, and most recently in January of 2021, SPACs have pulled in more than 70% of all money raised through IPOs. Right now, there are 287 active SPACs looking to merge with targets that are interested in going public. Given the dry powder sitting in SPACs and the 18-24 month time frame allotted to complete mergers, this alternative process for going public will be a more viable option for companies in the years to come.

Past Blogs that Help Understand the Trends of Today

We all wanted a fresh start in 2021, but that will not exactly happen. Reflecting back and taking inventory of the lessons from last year, we can be hopeful that the application of these lessons will make 2021 better because, as we all know, history repeats itself. Now we’ll take a look at some of our previous blogs that can help companies address the early trends of 2021 and capture these opportunities to maximize long-term shareholder value.

- Why does trading volume matter?

Volume is a technical indicator used by traders that represents a stock’s activity and momentum. Increasing volume is associated with higher prices and decreasing volume with lower prices. Low average trading volumes are unfavorable for both companies and investors. It acts as a barrier to entry for institutional money managers who are interested in building a meaningful ownership position. Trading in these names is less efficient; prices are more sensitive to volume, which creates situations where investors are bidding up prices on themselves. - What is a shelf registration?

SEC Form S-3 is known as a shelf registration. This allows public issuers to “pre-register” securities of a specified total dollar value without specifying the issuance date or terms, such as type, amount, and price. For growth companies that will inevitably look to raise capital within the three-year duration of the registration, these filings are considered good housekeeping. They provide expedited access to capital markets, since the SEC has already provided clearance. With that, issuers can be opportunistic in favorable market environments. - Considerations if your company is planning on going public through a SPAC

An IPO is not the only way your company can go public. In fact, one of the fastest ways to go public is through a merger with a special purpose acquisition company or an SPAC. Essentially, these are shell companies, where reputable investors and operators attract money in an IPO with the intention of finding a private company to merge with, thereby taking a large stake in the company and offering the immediate public company infrastructure. This is why SPACs are referred to as “blank check” companies and how target or acquired companies can become public in as little as two months at a cost significantly less than a traditional IPO. This forms a compelling proposition for the right situation.

If you have any questions about our outlook for 2021 or would like to discuss how we implement best practices based on fundamental IR principles, please don’t hesitate to reach out to our team.

Philip ‘Trip’ Taylor, Vice President

Leave a Reply