The efficacy and availability of GLP-1s have caused a dramatic and unprecedented sell-off across the MedTech sector. Understanding management teams are well versed in many of the street’s views and concerns already, our Gilmartin team composed a quick synopsis of major events (both recent and forward-looking) and our recommendations for companies.

Newsflow

- At the American Diabetes Association (ADA) meeting in late June, Eli Lilly and Novo Nordisk presented data showing sustained weight loss with semaglutide therapies, sparking questions around their potential long-term impact on demand for diabetes products, namely CGM and pump therapies.

- On July 20, Intuitive Surgical (ISRG) reported a slowdown in bariatric surgery volumes on its Q2 earnings call.

- On Aug. 8, Novo Nordisk announced headline results from the SELECT cardiovascular outcomes trial, demonstrating a statistically significant and superior reduction in major adverse cardiovascular events (MACE) of 20% for people treated with semaglutide 2.4 mg compared to placebo. The strength of results vs. expectations raised conviction in the potential benefits of GLP-1 therapies for patients with health conditions spanning diabetes, sleep apnea, and cardiovascular diseases, while fueling concerns around the potential impact to interventional procedure volumes and broader MedTech end markets.

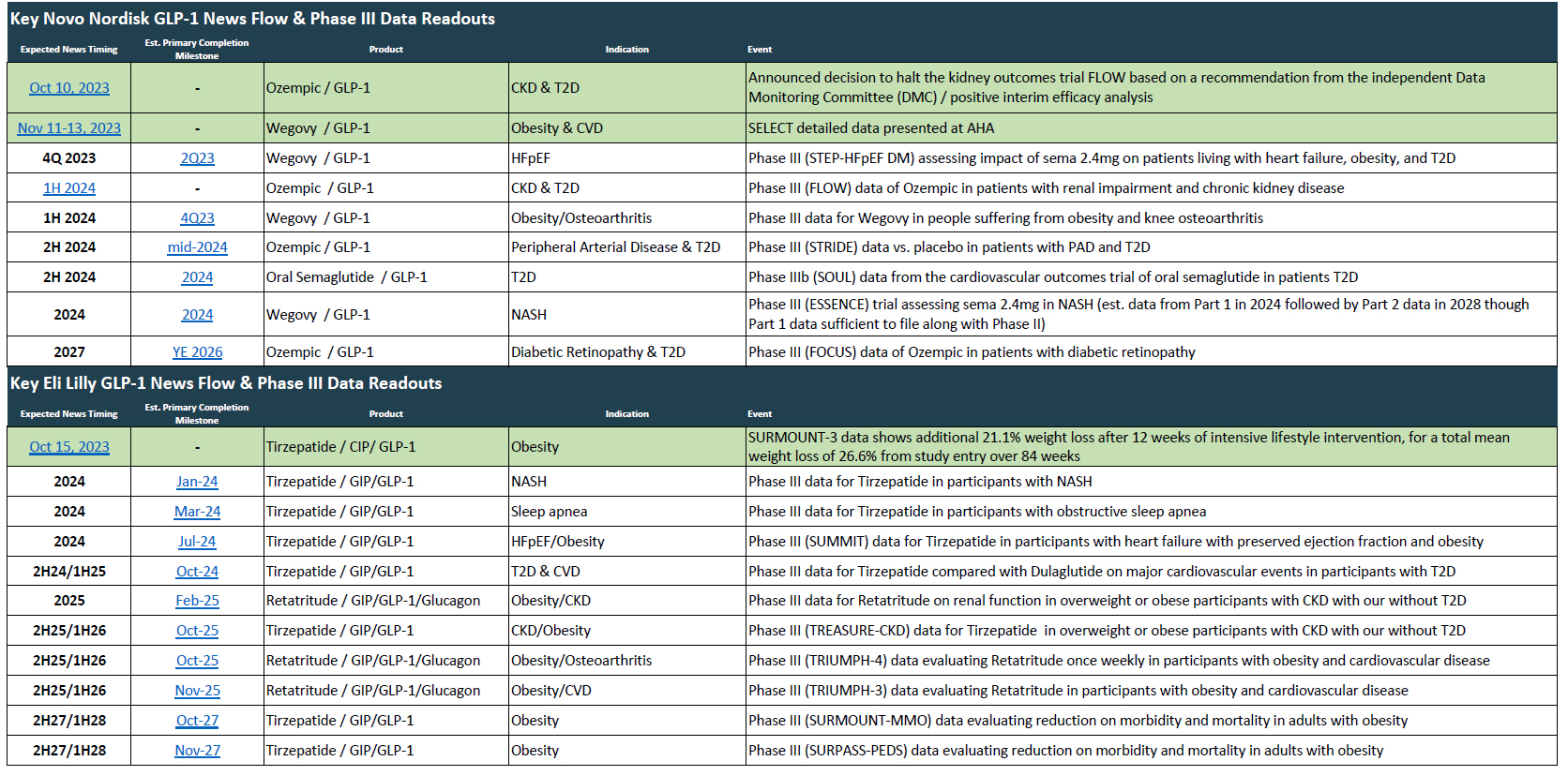

- On Oct. 10, Novo Nordisk announced it had stopped its FLOW trial early due to the fact that results from an interim analysis met pre-specified criteria for stopping the trial early for efficacy. FLOW is intended to assess Ozempic in the prevention of progression of renal impairment and risk of renal and cardiovascular mortality in people with type 2 diabetes and chronic kidney disease (CKD).

- Dialysis and kidney transplant-exposed stocks (including Baxter, CareDx, DaVita, Fresenius, Natera, Outset Medical, and Transmedics), fell double-digits in response.

Market Reactions & Trading Commentary

- Trading commentary from banks such as JP Morgan and Morgan Stanley (alongside public data) suggests that generalist long-only funds are reducing and exiting MedTech positions, with both MedTech and healthcare now underweight within many portfolios.

- Oct. 10-13 may have represented capitulation as stock movement post FLOW news exceeded that of SELECT headline data in August.

- MedTech valuations now sit at 10-year lows with stocks experiencing 10-30% multiple compression across subsectors and capitalizations.

The Path from Here

- Final SELECT data, scheduled for presentation at AHA (Nov 11-13), is the next major focus for investors. We expect investors to remain cautious into the SELECT readout given the significant number of secondary endpoints that could carry derivative implications.

- Meanwhile, rising rates and concerns around future year earnings and cash flow are driving investors to place a greater premium on profitability now (or certainly sooner than in prior periods).

- Especially in the context of GLP-1 concerns on long-term MedTech growth achievability, many investors are hesitant to dig deeper into stocks and stories without a clear, and ideally risk-adjusted, path to profitability.

Gilmartin View & Recommendations

- The magnitude of stock moves and liquidity are driving increasing short-term fear – but the primary investor concern is that there are future trials ahead and potential expanded indications (with few side effects) for GLP-1s. Investors are having a hard time developing a thesis for a recovery.

- As a firm, our perspective is that the evolution of population health, patient disease states, and various medical device end markets in the presence of GLP-1s is far more nebulous than what can be reliably identified as a quantifiable headwind or tailwind. Said plainly – it’s hard to disprove the negative or quantify perceived existential threats.

- We do believe it is important for most companies- first, internally– to develop an informed view of potential impact from GLP-1s. From there, strategize messaging and create a deliberate approach to address investor sentiment during Q3 reporting season and into 2024.

Specific Actions

- Don’t play into the fear. Remain confident in the end market fundamentals of your business and specific disease states, but be proactive in addressing questions from investors.

- Have an informed view of what the introduction of GLP-1s to your company’s end market(s) might mean, and be prepared to discuss what analytics have contributed to informing your view – KOL discussions, available data, commentary from medical societies, etc.

- These preparations should be both mechanistic/clinical and commercial.

- For example – if, biologically, GLP-1 mechanisms or weight loss has little bearing on incidence levels in the disease state addressed by your business, consider reminding investors that even in an eventuality where your TAM is some % smaller over time, your penetration into that end market remains in early stages (ideally, quantify this) with a massive opportunity remaining.

- Be prepared to share commentary. Investors recognize the difference between tangible and perceived risks, but they will likely be dissatisfied with commentary that GLP-1s do not impact your business at all. Create talking points to address concerns and communicate that your company is closely following GLP-1 developments and potential market implications. At the same time, you are focused first and foremost on executing your ongoing business strategy.

- Our general advice is to leverage standard-cycle communications (e.g., quarterly prepared remarks or carefully crafted Q&A responses during public calls) rather than more reactive, “out-of-cycle” statements – however, this will also be company dependent.

- Be deliberate in deciding whether it’s appropriate to weave this view proactively into your external talk track, including Q3 earnings commentary, investor presentations, and other public comments or in preparation for Q&A. There is no ‘one size fits all’ approach.

- Drive fact-based answers and a thoughtful approach. Prepare to be pressed on the size of your end markets and asked about your company’s patient demographics, including how they have evolved in recent months and years, as well as expectations for the future.

- Understand the audience in your investor conversations. It is now more important than ever. Healthcare portfolio analysts will be in the weeds on the topic vs. growth-oriented and generalist investors.

- Profitability matters. If you have introduced a path to profitability, prioritize delivering on it. If you’re on track, reiterate it.

For many companies, there are too many unknown variables to accurately quantify potential changes in market growth rates or patient behavior. We believe that investors understand that, but still expect you to opine on what drives the error bars around your business.

We recognize this is a lot to digest, and we are happy to talk further. Please contact our team today to discuss how we can be of strategic advisory.

Authored by: Marissa Bych, Principal, Gilmartin Group