2024 started off with renewed optimism for the sector. Now, nearly six months into the year, it appears the set-up was not all that conservative for growth LS tools – with a number of companies posting disappointing revenue for the first quarter. In diagnostics, sentiment has remained positive with companies delivering better than anticipated volume and ASP growth. Diagnostics stocks have been outperforming due to these results combined with strong fundamentals, catalyst-rich pathways and significant progress on core profitability.

Importantly, the sector’s IPO drought ended last week with Tempus AI pricing at $37 per share (at the top end of the $35-$37 range), raising $410 million, and landing at a valuation of more than $6 billion. This offering marked the first LS tools / diagnostics IPO since October 2021. On the M&A front, there has been an active flow of transactions. Deal sizes have, on average, been smaller than last year with large caps focusing on assets at depressed valuations that will not be a material drag on margins and/or cash burn.

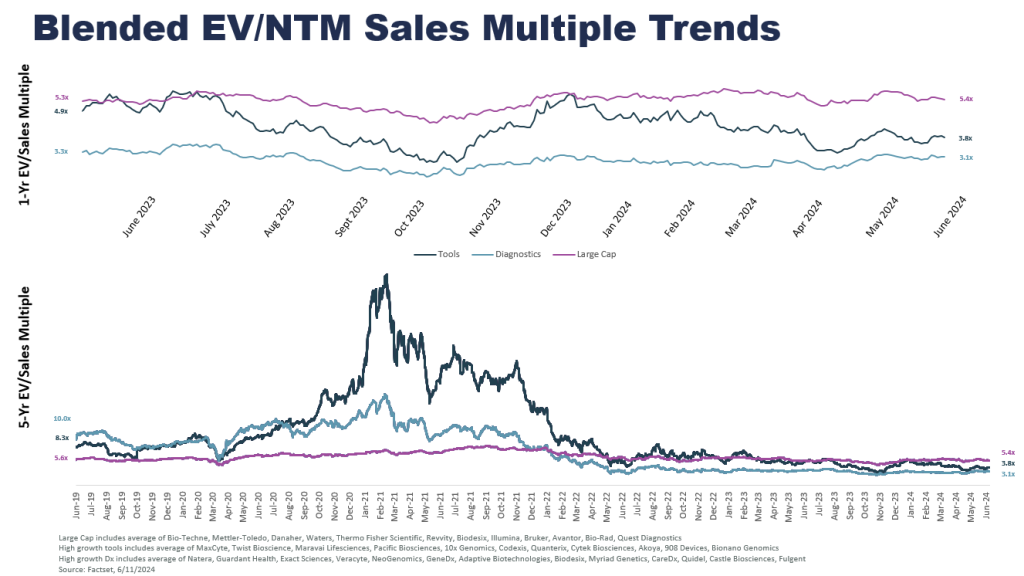

Valuations have stabilized at depressed levels with potential for improvement

Large caps have certainly seen a much lower level of volatility over the last five years compared to growth companies over the same period. Valuations are roughly in line to where they were a year ago (with an average multiple of 5.4x).

Valuations for growth tools/diagnostics companies are a different story. Since the massive spike in 2021, valuations for specialty tools companies have come down significantly – over 10-fold – from an average multiple of over 40x to around 4x. There was a notable dip following a disappointing Q1 earnings cycle.

For growth diagnostics companies, valuations have held relatively stable since the start of the year, with multiples at roughly 3x revenue. While this group has seen strong momentum in the last few weeks, valuations are historically low at a blended multiple of 3.1x, reflecting about a third of the levels they were at five years ago at 10x.

Natera is a notable outlier amongst the diagnostics growth group, trading at 8.5x next-twelve-month revenue (compared to 5.6x revenue at the start of the year). In the diagnostics group, it is notable that the two companies with the highest multiples – Natera and Guardant – reached profitability targets at or ahead of schedule in the first quarter. The drive towards profitability is expected to be one of the biggest drivers of valuation expansion in the growth tools/diagnostics sector.

Continued M&A and sector consolidation

We saw M&A activity start to pick up in 2023 with nearly 40 acquisitions across the sector. This included several larger deals – Thermo Fisher acquiring Olink, Danaher acquiring Abam, Waters acquiring Wyatt – with double-digit forward-looking revenue multiples.

In the first half of 2024, there have been more than 20 acquisitions announced to date (many of these smaller deals with undisclosed terms) as larger companies take advantage of depressed valuations. Quest, Labcorp and Bruker have been particularly active and have collectively made nine acquisitions: two for Quest (PathAI Diagnostics and Steward Health Care System assets), two for Labcorp (Bioreference and post-bankruptcy Invitae assets) and five for Bruker (Nanophoton, Spectral Systems Imaging, Tornado Spectral Systems, Nion, and, most recently, NanoString assets post-bankruptcy).

While we expect to see this activity continue throughout the remainder of the year, acquiring companies are intensely focused on preserving an attractive financial profile.

As we look ahead…

Another big event is on the near-term horizon with the Grail spinout from Illumina set to take place on June 24th. At their recent capital markets day, management shared they will be well capitalized with $1 billion of pro forma cash following the spin (approximately 2.5 years of cash taking them through 2026). They ended 2023 with $93 million of revenue and anticipate 30–50% revenue growth for their Galleri test in 2024. There continues to be questions about Galleri’s path to reimbursement. Given that overhang, coupled with a high burn rate, it will be interesting to see how Grail is received by public market investors.

For public companies, at mid-year, investors are already beginning to look ahead and think about the set up for 2025. Heading into Q2 earnings, many growth LS tools have guides that imply a steep ramp for the second half of the year (anticipating some end market improvement). Q2 topline growth, updates on revenues guides and end market commentary will be key to provide more clarity on expectations for next year. Growth diagnostics companies have seen stronger momentum year-to-date and have broadly signaled continued volume growth for the remainder of the year. Investor focus here will be on test ASPs, gross margins and path to profitability.

Across the board, execution alongside clear and concise messaging is key. Gilmartin Group has extensive experience working with both private and public companies across the Life Science Tools & Diagnostics space. To find out more about how we strategically partner with our clients, please contact our team today.

Authored by: Carrie Mendivil (Managing Director), Ji-Yon Yi (Vice President), and Kelly Gura (Associate Vice President), Gilmartin Group