Strong Fundamentals Driving Valuation Recovery

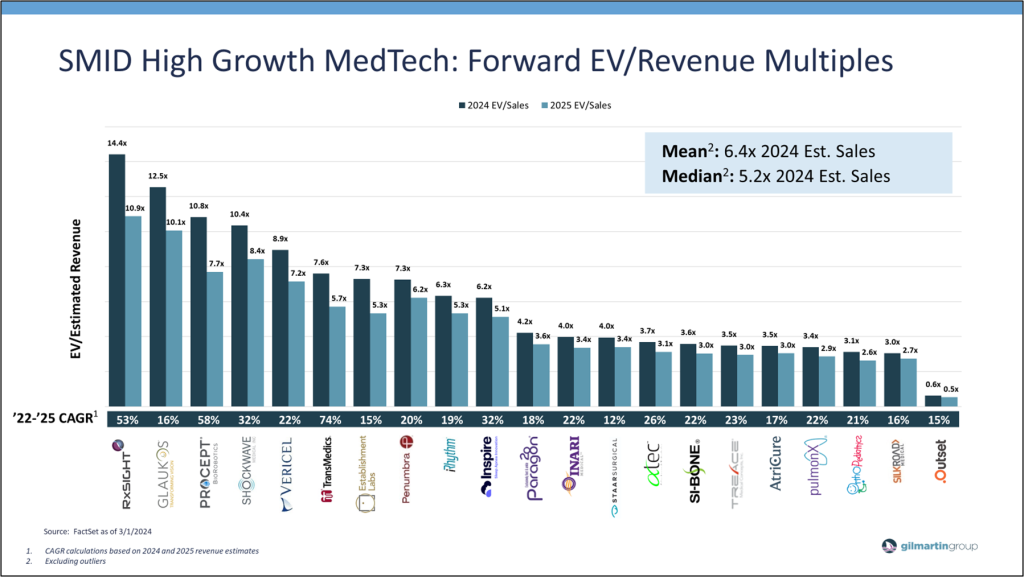

As we close the book on 2023 and move deeper into 2024, MedTech fundamentals remain overwhelmingly positive. Procedure volumes, utilization, pricing trends, and the pace of regulatory approvals and new product launches are improving from recent years. Meanwhile, macro dynamics (ex: supply chain issues, staffing delays, and high inflation) have stabilized, and following a strong end to 2023, healthy growth expectations have rolled into 2024. In tandem, company valuations have bounced back from recent lows. As of today, high growth SMID MedTech average forward EV/Revenue multiples have recovered from 4-5x in 2023 to 6-7x, reflecting improving sentiment and anticipation for a more conducive environment for growth on both the top and bottom line.

Where to From Here?

Given a solid operating environment and clear guidance now set across the sector, we hope to see a stable-to-improving valuation environment looking forward. We aren’t expecting an acute upswing in MedTech multiples (considering few catalysts for the sector over upcoming months), but we are keeping a close eye on trends that could put the sector back in relative favor over the course of the year and beyond – for example: stronger-than-expected growth from new product launch cycles (ex: pulsed field ablation, renal denervation, and automated diabetes management devices) or sensitivity and risk aversion to pharma policy-related risk into the upcoming election cycle. Reach out to our team to talk about evolving market dynamics and factors that might be particularly relevant for investors taking a look at your business.

Focus on Profitable Growth

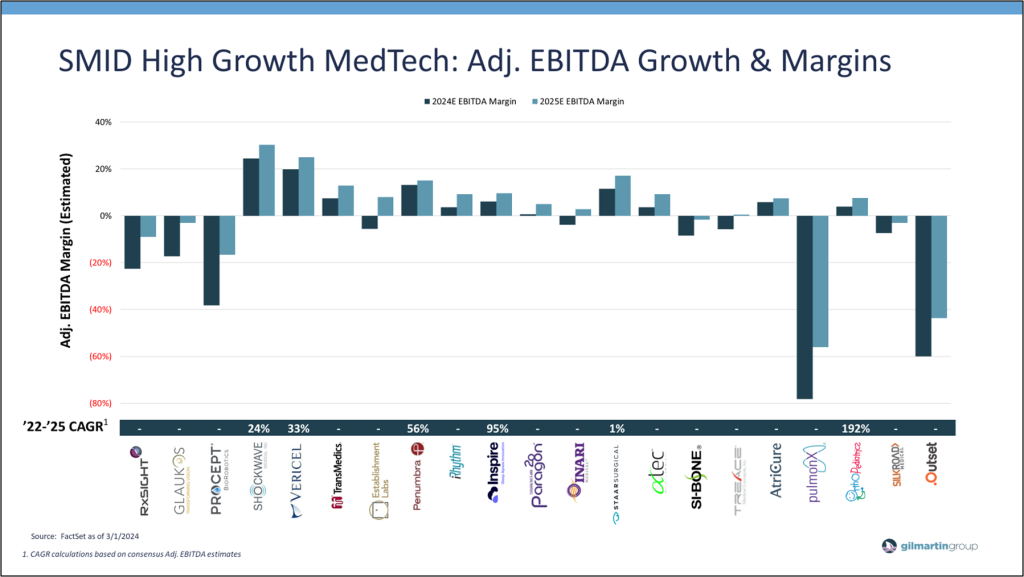

Investor quality screens also continue to evaluate high growth SMID MedTech companies for Adjusted EBITDA and margin expansion trends, with attention given to companies at an inflection point. While organic growth remains important in value creation, profitability and cash flow have remained a central focus. Similar to the rest of the market, MedTech valuations were inversely correlated with real treasury rates. Therefore, as interest rates declined, investors focused more on revenue growth than profitability and valuations rose. However, under quantitative tightening, heightened focus on profitable growth and cash generation has raised the “quality screen” for MedTech companies as investors key in on continued top-line growth, alongside a steady focus by management teams to improve operating leverage through prudent growth and cost initiatives, leading to somewhat healthy margin expansion, cash flow, and value creation. As illustrated, high growth SMID MedTech companies are expected to generate improving Adj EBITDA growth and margins in coming years on firm underlying business fundamentals and prudent management execution.

Optimistic for an Improving Deal Environment

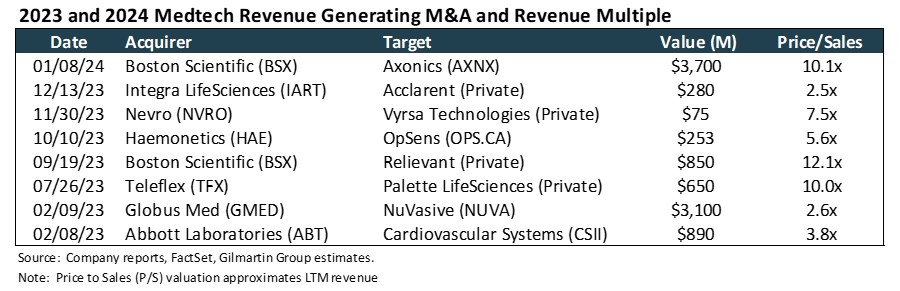

Our positive outlook for 2024 is reminiscent of past environments marked by dynamic dealmaking and capital raise activity. We anticipate that growth-focused tuck-in acquisitions will remain an important value creator this year, as cash rich companies look to meet rising growth expectations while executing operating leverage improvements and cash generation. As shown below, recent acquisitions of revenue-generating MedTech companies have closed at a premium.

Our team is engaging in a significantly greater number of IPO readiness discussions than in the past 1-2 years given a substantial backlog of scaled medtech businesses that could be well positioned to raise capital via the public market in the near-term.

Further, a look at the biotech financing environment (often a leading indicator for other sectors of healthcare) would suggest that demand for new issue deals is alive and well. Year-to-date, more money has been raised in biotech IPOs, follow-ons, and overnight transactions than across the entirety of 2023. And in cases where transactions followed on heels of strong clinical data, investors have been willing to ascribe high valuations (ex: CG Oncology, whose stock has held above $42 / share for over a month following its upsized IPO which initially priced at $19 / share in January). We see the potential for heightened biotech activity to usher in positive deal momentum for MedTech as the year goes on.

In Summary

2024 is shaping up to be a promising year. Positive sentiment, strong underlying fundamentals, and improving valuations lay the foundation for additional value creating events. As management teams focus on execution, it is important take the right proactive steps to benefit from potential capital market opportunities. Reach out to our team to talk more about your business and strategic positioning in this environment.

Gilmartin Group has extensive experience working with both private and public companies across the MedTech space. To find out more about how we strategically partner with our clients, please contact our team today.

Authored by: Vivian Cervantes, Managing Director and Steve Yeung, Associate Vice President