The pandemic continues to accelerate the adoption of technology throughout the healthcare sector and investors are taking notice. Pre-COVID, many established companies and start-ups entered the digital health market by solving issues related to the delivery and management of healthcare through technology. The subsequent regulatory changes and increased awareness have helped accelerate adoption, particularly in telehealth services, as many patients tried virtual visits for the first time. In 2020, both public and private funding reached record levels and the momentum is expected to continue into 2021.

Key Considerations:

- Telehealth services revenue growth highly correlates with the level of private investment in computers and software. For instance, interactions between patients and healthcare providers have significantly benefited from technological expansions in communications tools, such as mobile devices and platforms, with improved audio and video transmission.

- Industry revenue growth is supported by advancements in medical technology. As new medical devices, such as self-monitoring tools, are introduced to the market, demand for telehealth services also increases.

- An aging population vulnerable to chronic disease has aided industry revenue growth. As the number of people aged 65 and older rises, demand for telehealth services will likely increase.

- Furthermore, with an increase in chronic diseases, federal funding for Medicare and Medicaid are expected to rise. As more healthcare providers utilize telehealth services to treat and manage these conditions, industry profitability will grow.

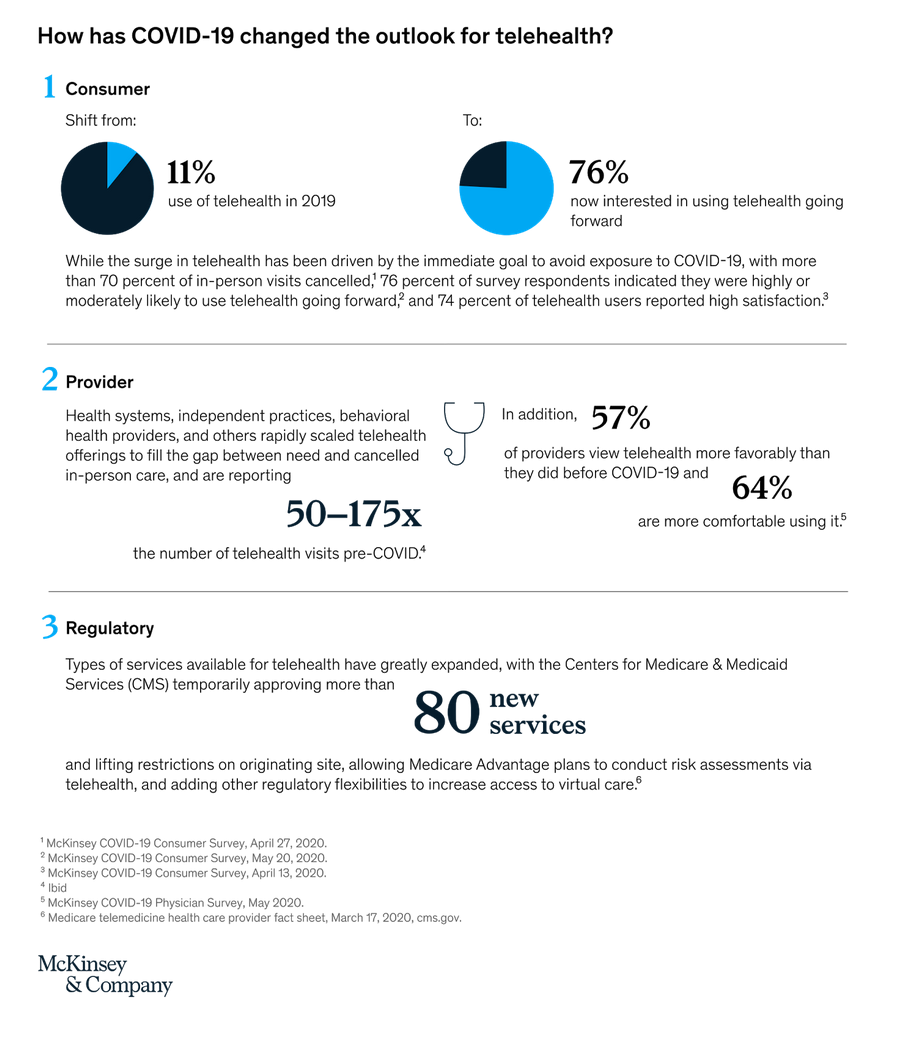

2020, however, was a pivotal year for the Telehealth Services industry. Due to the contagious nature of the COVID-19 virus, in-person healthcare visits and services were disrupted. As a result, many healthcare providers opted to use telehealth as a safer alternative to treat patients and avoid spreading the virus. The stress and fear instilled from the pandemic created further opportunities to utilize these solutions to manage the increasing demand for mental health services. According to a study conducted by McKinsey, “consumer adoption has skyrocketed, from 11 percent of US consumers using telehealth in 2019 to 46 percent of consumers now using telehealth to replace cancelled healthcare visits. Providers have rapidly scaled offerings and are seeing 50 to 175 times the number of patients via telehealth than they did before.” The acceleration in telehealth adoption from both consumers and healthcare providers have created a massive opportunity for the industry moving forward. The report forecasts that, “up to $250 billion of current US healthcare spend could potentially be virtualized.”

How to capitalize on the telehealth opportunity?

- Develop a model that captures utilization trends and metrics of telehealth services. Stay informed on evolving consumer preferences, reimbursement, technology, and regulations.

- Analyze the opportunity that telehealth services can provide for each individual solution.

- Create a business model that clearly defines your value proposition, then develop a set of inputs and expected outcomes.

- Determine strategies that deliver attractive returns and sustainable value for investors.

As the broader healthcare sector continues to evolve through demographic and structural changes, the Telehealth Services industry will likely emerge as an alternative solution that addresses the medical needs of consumers.

Gilmartin has partnered with many clients to implement best practices and achieve public company readiness. For additional information, please contact our team today.

Sources:

- Telehealth: A quarter-trillion-dollar post-COVID-19 reality? – www.mckinsey.com/industries/healthcare-systems-and-services/our-insights/telehealth-a-quarter-trillion-dollar-post-covid-19-reality

- Improving care and creating efficiencies – www2.deloitte.com/us/en/insights/industry/health-care/digital-health-trends.html

- Digital Health Technology Vision 2020 – www.accenture.com/_acnmedia/PDF-133/Accenture-Digital-Health-Tech-Vision-2020.pdf#zoom=40

- Telehealth Service Industry Report – my.ibisworld.com/us/en/industry-specialized/od5775/about

[/fusion_text][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” content_alignment_medium=”” content_alignment_small=”” content_alignment=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” sticky_display=”normal,sticky” class=”” id=”” font_size=”” fusion_font_family_text_font=”” fusion_font_variant_text_font=”” line_height=”” letter_spacing=”” text_color=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=””]

Michai Zlatopolsky, Analyst

[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]

Leave a Reply