[fusion_builder_container hundred_percent=”no” equal_height_columns=”no” menu_anchor=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” parallax_speed=”0.3″ video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” overlay_color=”” video_preview_image=”” border_size=”” border_color=”” border_style=”solid” padding_top=”” padding_bottom=”” padding_left=”” padding_right=””][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ background_position=”left top” background_color=”” border_size=”” border_color=”” border_style=”solid” border_position=”all” spacing=”yes” background_image=”” background_repeat=”no-repeat” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”0px” margin_bottom=”0px” class=”” id=”” animation_type=”” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” center_content=”no” last=”true” min_height=”” hover_type=”none” link=”” first=”true”][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=””]

Overview

The NASDAQ Biotechnology Index (NBI) is a stock market index made up of NASDAQ-listed securities classified either as “biotechnology” or “pharmaceutical” by the Industry Classification Benchmark (ICB), an industry classification taxonomy launched by Dow Jones and FTSE in 2005. It is calculated under a modified capitalization-weighted methodology.

The Index began on November 1, 1993 at a base value of 200.00. At the time of writing, the NBI index currently sits at 4,064 and is comprised of 206 securities. It is run by NASDAQ Global Indexes.

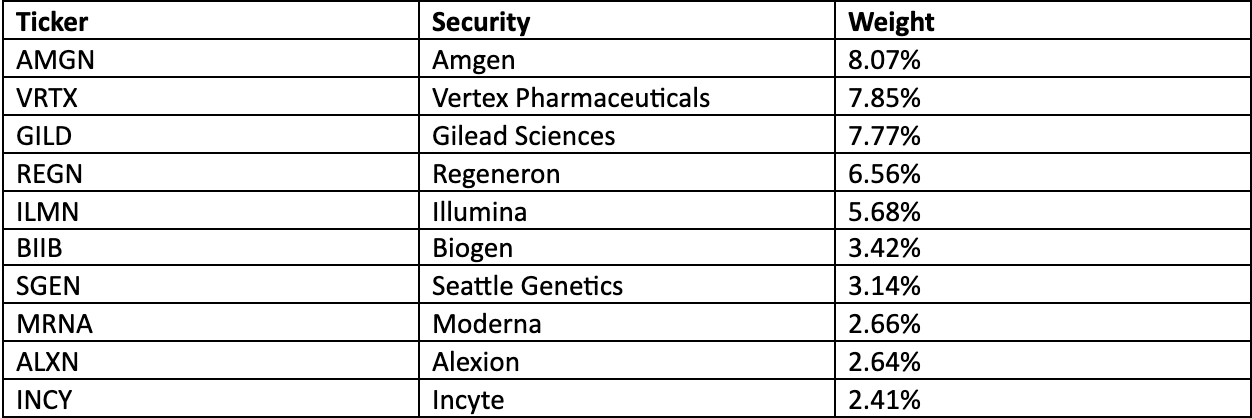

Top 10 Largest Constituents of the NBI as of June 2020

Source: NBI, as of 6/30/2020

Pfizer (PFE), Eli Lilly (LLY), Merck (MRK), and Johnson & Johnson (JNJ) are not in the index because they are all NYSE-listed and therefore not eligible for inclusion. As such, the NBI tends to be more representative of mid- and small-pharma, rather than big-pharma.

What are the NBI’s inclusion criteria?

In order to be a part of the NBI, each security must:

- Be exclusively listed on the Nasdaq Global Select Market or the Nasdaq Global Market.

- Be ICB classified as either Biotechnology or Pharmaceutical.

- Have a minimum market capitalization of $200M.

- Have an average daily trading volume of at least 100,000 shares.

- Not be in bankruptcy proceedings, or have entered into an agreement (acquisition, etc.) that would result in it failing other requirements.

How often is the index updated?

NBI constituents are selected/updated once annually in December. The eligibility criteria are applied using market data as of the end of October, with total shares outstanding (used for weighting) as of the end of November. The index reconstitution is announced in early December (2019’s was announced on December 13), with new inclusions/exclusions effective after the close of trading on the third Friday in December; in 2019, this was December 23.

In addition, the index is rebalanced on a quarterly basis in March, June, September and December – to take account of how companies’ market capitalizations have changed. The rebalances use the total number of shares outstanding and last sale price for each security as of the prior month-end (i.e. February, May, August and November respectively). Rebalance changes are announced in early March, June, September and December, and they become effective after the close of trading on the third Friday in March, June, September and December.

Should I care about the NBI?

There is a prestige that accompanies a stock’s NBI inclusion, since being part of the NBI means you meet all of the necessary requirements for being included.

There are also a number of funds, including exchange traded funds (ETFs), that track the NBI, including the ProShares Ultra NASDAQ Biotechnology ETF (BIB), ProShares UltraShort NASDAQ Biotechnology ETF (BIS), Invesco NASDAQ Biotech UCITS ETF (SBIO); iShares Nasdaq Biotechnology Index Fund (IBB); Capital NASDAQ Biotechnology Index Exchange Traded Fund (678); ProShares UltraPro Nasdaq Biotechnology ETF (UBIO); ProShares UltraProShort Nasdaq Biotechnology ETF (ZBIO); Tachlit Nasdaq Biotechnology ILS (TCBI105); and Mirae Asset TIGER Nasdaq BIO ETF (203780). At the time of writing, the combined assets of these funds exceed $10 billion.

While the above information implies a > $800 million NBI-linked investment in AMGN, the incremental demand for stock represents less than 1% of its current $140 billion market capitalization. Since the index is market-capitalization-weighted, the index should not be significantly more important for any other NBI-included security.

The NBI – more useful as a performance benchmark

Given its bias towards mid- and small-cap pharma, the NBI index is very useful as a benchmark. Publicly listed biotechs will frequently use the NBI to benchmark their stock performance over a given period, particularly in board presentations, to determine under- or overperformance. In this sense, it is a more meaningful benchmark than the S&P 500, Nasdaq Composite or Dow Jones Industrial Average, since it contains a peer group of companies with materially more comparable risk profiles.

If you have any questions about the NBI, contact our team today.

[/fusion_text][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=””]

Serge Yusim, Analyst

[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]

Leave a Reply