Family offices around the world have become increasingly active and sophisticated in their investment into innovations over the years. The growth of family offices and their broadened investment mandates have led to an expanding influence in venture capital and private equity.

While the spotlight on investment capital has often focused on more traditional sources (i.e., investment banks, hedge funds and private equity firms), family offices have been quietly building their status in the background. It is evident today that the once traditional role of a family office has continued to evolve within the investment community, both directly and indirectly. Additionally, as various investment themes such as impact and ESG investing have surfaced, family offices have taken a keen interest in these investments.

The Growth of Family Offices

In our previous dive into family offices, we wrote about how family offices are one of the fastest-growing investment vehicles in the world today. The increasing concentration of wealth held by very wealthy families and rising globalization has fueled their growth.

Estimates of the number of family offices around the world now range from 7,000 to 10,000. Over half of these family offices were founded in the last 15 years. One organization that closely monitors wealth trends among the world’s wealthiest families is Campden Wealth, a family office membership association. Their research arm, Campden Research, estimated in 2019 that there are now 7,300 family offices, a 38 percent increase over the previous two years. These offices are also estimated to manage more than $6 trillion, compared to the $3.96 trillion in global hedge funds1. While the relatively unpublicized growth of family offices may surprise you, they prefer it this way.

A Changing Investment Direction

Family offices have historically focused on liquid bond and equity markets, passive alternative investments, such as allocations to hedge fund and private equity managers, and direct property investments. However, these traditional asset allocation decisions have broadened as private markets have developed.

Family offices today are increasingly favoring direct investments. They are adapting their investment approach to better reflect and align with the family’s values. The historical bar bell approach, which allowed wealth creation to focus on maximizing returns and channeled social conscience into philanthropy, is changing. The rising generation of wealth holders in these families are seeking more alignment across the board. They are seeking to make a difference through investments and becoming more influential within their families. This significant shift in interest has led to greater openness, which in return has created greater alignment between this next generation of investors and the existing generation of entrepreneurs.

Trends in Family Office Venture Capital Investments

Family offices around the world have been very optimistic about making investments in venture capital. The pandemic has accelerated their interest and according to financial experts, they are here to stay for the long term.

Campden Wealth in partnership with SVB Capital, the global venture capital investment arm of SVB Financial Group, recently released reports that evaluate the global trends of family offices investing in venture capital. Here are some of the key takeaways2:

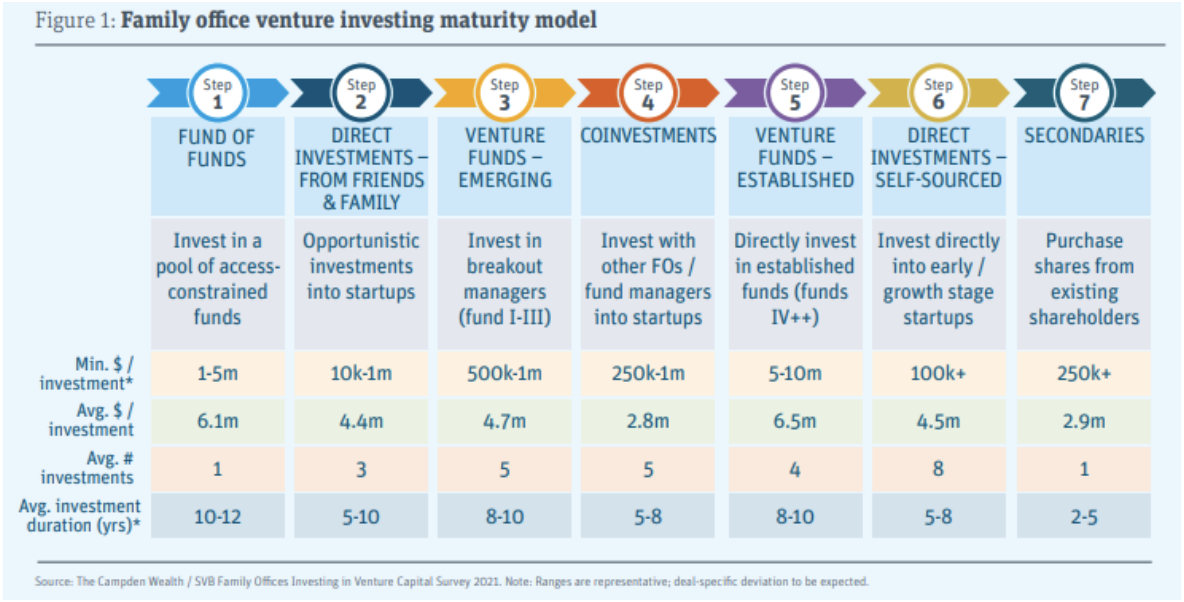

- Family offices progress through a similar path in their venture capital investing journey

- Although every family office is unique, their venture investing journeys are similar. Family offices typically make their foray into the sector by investing in venture funds. Then, as they gain experience, they progress into making direct investments into early and growth-stage startups, investing an average of $4.5 million per deal.

- In 2020, the average global family office held 46% of its venture portfolio in funds and 54% in direct investments. The split remains roughly the same in 2021.

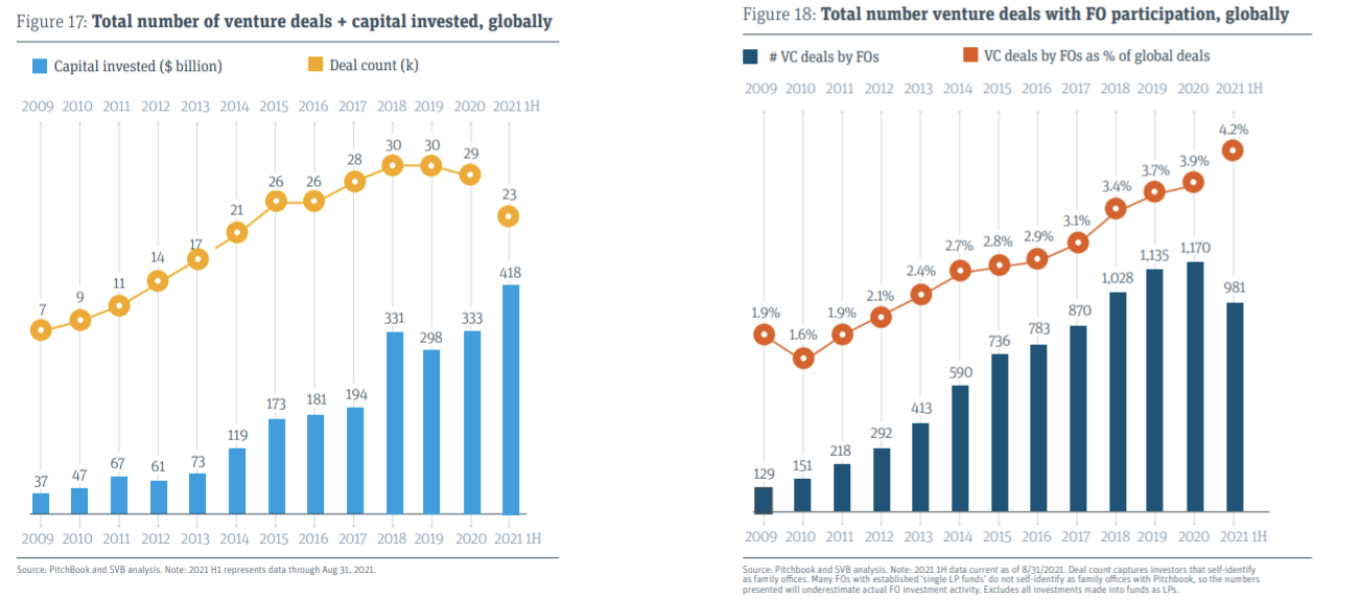

- Family office participation in venture continues to increase

- There has been an increased interest in direct investment opportunities by family offices over the past decade. Research shows that over three-quarters of family offices are engaged in direct deals.

- Startups are increasingly open to direct investments from family offices, alongside venture funds. Family offices, in turn, are investing strategic capital, adding value based on their operating businesses and network connections. The average family office venture portfolio comprises 17 direct investments and 10 fund investments, and within the next 24 months, family offices expect to make 18 new investments.

- Family office investors are preferring early-stage venture

- Though early-stage venture investments are risky, they tend to deliver stronger returns for family office investors. Research shows that most single-family offices have made investments in earlier stage seeds.

- Family offices are a good option to deliver smart money and patient capital. Most family offices also provide strategic guidance, participate on the board and facilitate connections to other investors.

- Impact and ESG investment opportunities

- Research shows that 47% of the family offices are involved in impact and ESG investments.

- The most significant sectors or industries of interest globally are Healthcare & Wellness (65%), Agriculture & Food (63%) and Energy & Sustainability (63%). In North America, Healthcare & Wellness is the top area of interest (74%).

- In 2021, 18% of family offices have venture investments in Life Sciences & Healthcare (i.e., biopharma, drug discovery, medical devices, diagnostics, etc.), which is the highest single sector exposure.

Trends in Family Office Private Equity Investments

Historically low interest rates have forced family offices to revise their investment strategies. They are attracted by the potential returns that can be generated from private equity. For many family offices, investing in private equity is nothing new. And similarly to venture capital, there has been a significant increase in interest.

UBS also recently released their annual Global Family Office Report that evaluates the global trends of family offices investing in private equity. Here are some of the key takeaways3:

- Private equity preferred

- Private equity offers opportunities not accessible in public markets, according to half (52%) of family offices.

- Family offices have become more involved as private equity has become a greater source of funding for the real economy. Research shows that the majority (83%) of family offices invest in private equity.

- There has been a sharp drop-off in the use of funds of funds, with co-investments and direct investments rising significantly. Research shows that 37% of family offices invested in funds or funds of funds in 2020, falling to 23% in 2021.

- In 2021, almost half of family offices (47%) invest in both funds and direct investments, up from 31% in 2020.

- In 2021, just under a third (30%) of family offices only invest in direct private equity, a similar level to 2020.

- Adapting to the investment environment

- Continued low interest rates have shaken family offices’ long-standing faith in fixed income. Looking forward five years, many plan to dial down their strategic asset allocation to low-yielding bonds and cash. Almost half (42%) of family offices intend to raise equity allocations in private equity direct investments.

- Seeking innovation and sustainability

-

- At a time when many companies are growing fast and disrupting the incumbents, there’s a quest to invest in the innovators. More than three quarters (77%) of family offices make expansion/growth equity investments, with that proportion being even higher in the U.S. (92%).

- Sustainable investments are entrenched in portfolios. More than half (56%) of families invest sustainably. As the most dynamic asset owners, family offices appear to be leading the evolution to ESG integration, planning to increase allocations to about a quarter (24%) of the portfolios.

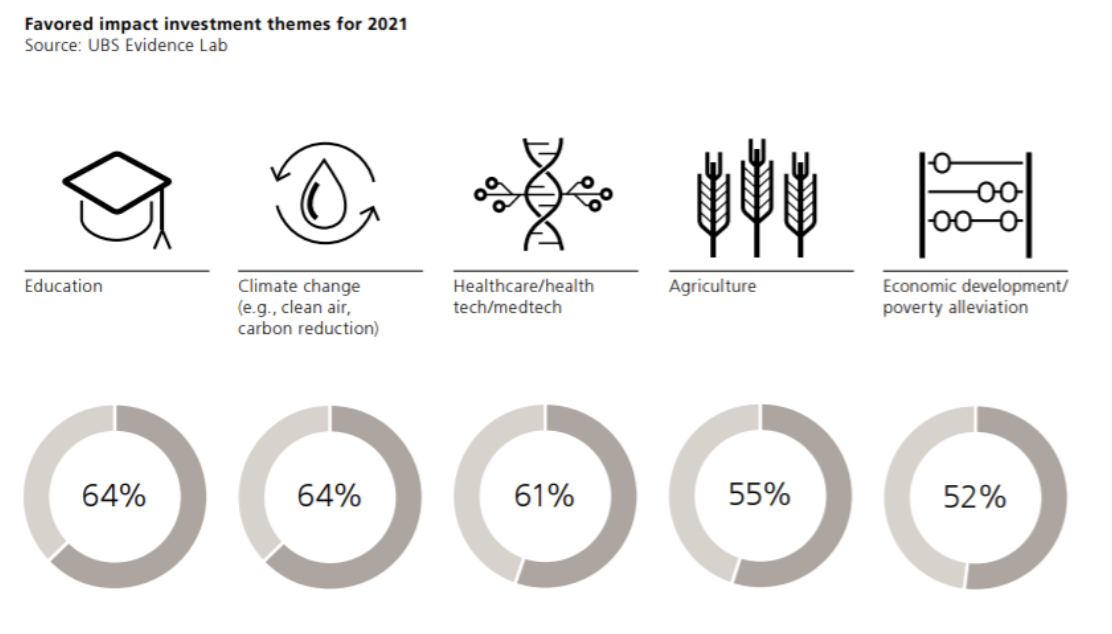

- The number of impact investments is growing. On average, family offices state they have impact projects across approximately six areas in 2021, versus four in 2020. While Education remains the most popular area, Climate Change and Healthcare are closely in line.

Conclusion

It is hard to deny the growing prevalence and impact of family offices within the investment community. Their once steadfast approach to investing has continued to expand and adapt with changing family and market dynamics. Family offices today provide an opportunity for many young and emerging companies to develop and grow. For more information about family offices, contact our team today.

- Beech, J. (2019, July 18). Global Family Office growth soars, manages $5.9 trillion. Campden FB. Retrieved from www.campdenfb.com/article/global-family-office-growth-soars-manages-59-trillion.

Williamson, C. (2021, September 20). Hedge fund AUM increases 14.2% on disruptions. Pensions & Investments. Retrieved from www.pionline.com/special-report-hedge-funds/hedge-fund-aum-increases-142-disruptions. - O’Brien, B., Sachdeva, S., & Samuelson, D. (n.d.). (publication). Family Offices Investing In Venture Capital 2021-2022. Silicon Valley Bank . Retrieved from www.svb.com/trends-insights/reports/family-office-reports/family-office-report-2021.

O’Brien, B., Gooch, R., & Ally, M. (n.d.). (rep.). Family Office Investing in Venture Capital 2020. Silicon Valley Bank. Retrieved from www.svb.com/trends-insights/reports/family-office-reports/family-office-report-2020. - UBS . (n.d.). (rep.). Global Family Office Report 2021. Retrieved from www.ubs.com/global/en/global-family-office/reports/gfo-r-21-4-client.html.

Stephen Yeung, Associate

Leave a Reply