Over the past year, Wall Street has increased its focus on diversity and its implications for companies. This discussion is reflective of not only a broader national dialogue on social justice, but also an international emphasis on Environmental, Social, and Corporate Governance (ESG) investing. While European-based funds have thought about socially responsible investing for quite some time, this framework has become increasingly important to US-based asset managers.

Below, we take a look at the ways in which different Wall Street institutions and governing organizations are trying to address diversity and its implications for public companies.

New Board Requirements

Nasdaq

On December 1, 2020, Nasdaq filed a proposal with the SEC to adopt new listing rules related to board diversity. According to the Wall Street Journal, Nasdaq found that more than three-quarters of its listed companies would have fallen short of the proposed requirements in a review carried out over the past six months. Around 80% or 90% of companies had at least one female director, but only about a quarter had a second one who would meet the diversity requirements.

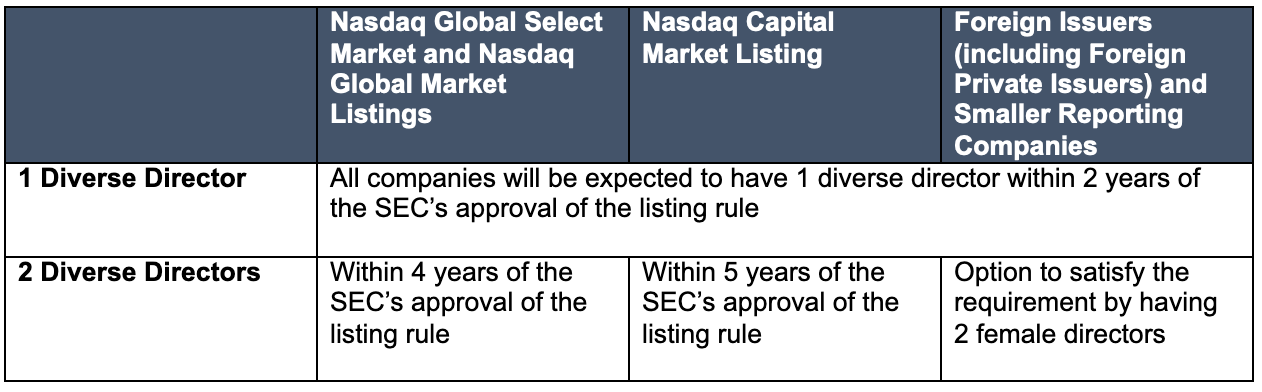

If approved by the SEC, the new listing rules would require all Nasdaq-listed companies to publicly disclose board-level diversity statistics through Nasdaq’s proposed disclosure framework within one year of the SEC’s approval of the listing rule. The timeframe to meet the minimum board composition expectations set forth in the proposal will be based on a company’s listing tier.

Additionally, the rules would require most Nasdaq-listed companies to have, or explain why they do not have, at least two diverse directors, including one who self-identifies as female and one who self-identifies as Black or African American, Hispanic or Latinx, Asian, Native American or Alaska Native, Native Hawaiian or Pacific Islander, two or more races or ethnicities, or as LGBTQ+.

All companies will be expected to have one diverse director within two years of the SEC’s approval of the listing rule. Companies listed on the Nasdaq Global Select Market and Nasdaq Global Market will be expected to have two diverse directors within four years of the SEC’s approval of the listing rule. Companies listed on the Nasdaq Capital Market will be expected to have two diverse directors within five years of the SEC’s approval. Finally, foreign issuers (including foreign private issuers) and smaller reporting companies, by contrast, may satisfy the requirement by having two female directors.

Nasdaq is also partnering with Equilar to enable Nasdaq-listed companies that have not yet met the proposed diversity objectives to access a larger community of highly-qualified, diverse candidates to amplify director search efforts.

Goldman Sachs

On January 23, 2020, Goldman Sachs indicated it will only underwrite IPOs in the US and Europe of private companies that have at least one diverse board member. Starting in 2021, the company will raise this target to two diverse candidates for each of its IPO clients.

CEO David Solomon referenced how since 2016, US companies that have gone public with at least one female board director outperformed companies that do not, one year post-IPO. He also highlighted how over the two years leading up to this policy, over 60 companies went public in the US and Europe without a diverse board member.

State of California and Subsequent State Legislation

In 2003, Norway was the first country to pass a law that required public companies to have >40% of board seats held by women. Before California became the first US state to pass a board diversity law in 2018, other European countries (i.e., France, Spain) had implemented similar diversity laws.

On September 30, 2020, California Governor Gavin Newsom signed into law a measure that will require publicly-held corporations in California to achieve diversity on their boards of directors by January 2023. This law follows the passage of its 2018 law mandating that public companies headquartered in the state have at least one woman on their boards of directors by the end of 2019, with further future increases required depending on board size.

By the end of 2021, California-headquartered public companies are required to have least one director on their boards who is from an underrepresented community, defined as “an individual who self‑identifies as Black, African American, Hispanic, Latino, Asian, Pacific Islander, Native American, Native Hawaiian, or Alaska Native, or who self‑identifies as gay, lesbian, bisexual, or transgender.”

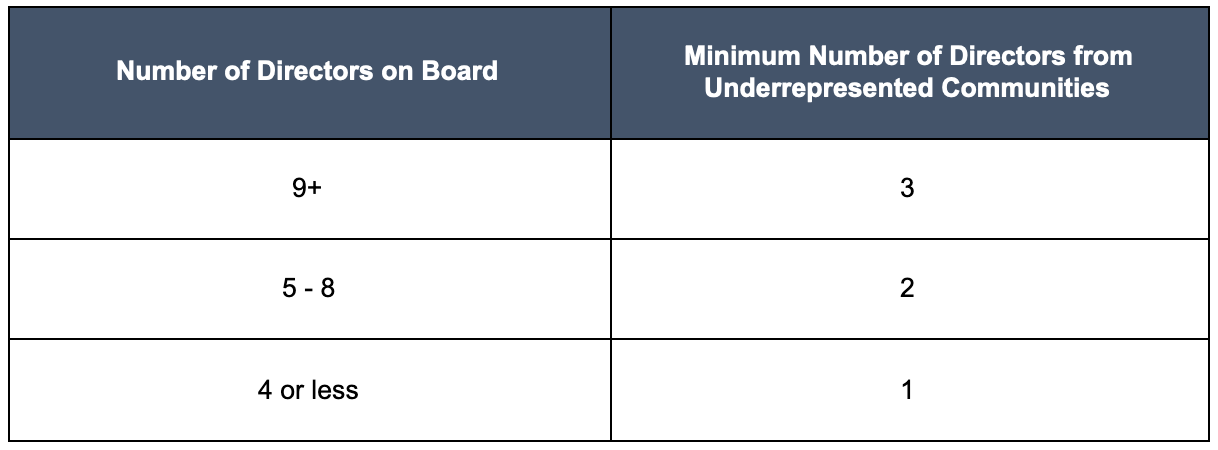

By the end of 2022, the number of diverse directors is required to increase, depending on the size of the board, as follows:

Source: Harvard Law School Forum on Corporate Governance “New Law Requires Diversity on Boards of California-Based Companies”. Posted by David A. Bell, Dawn Belt, and Jennifer J. Hitchcock, Fenwick & West LLP, on Saturday, October 10, 2020.

Companies are also considered compliant with the addition of one or more board seats, rather than removing directors, and in some cases the addition of one board member satisfies multiple requirements.

Although California is facing court challenges, other states have followed suit by passing similar measures. Both Washington and Illinois have passed board diversity legislation. Other states, like Hawaii, Massachusetts, and Michigan are in the process of drafting similar laws to be effective in coming years.

Implications for Public Companies

While some of these requirements have been challenged and it remains unclear if the SEC will approve Nasdaq’s proposal, Wall Street’s interest in diversity is here to stay. Notably Vanguard, State Street Advisors, BlackRock, and the NYC Comptroller’s Office include board diversity expectations in their engagement and proxy voting guidelines.

Companies can address the growing requirements and investor interest in diversity in the following ways:

- Work with counsel to develop a process for disclosing relevant information on diversity at the board level

- Prepare to discuss board composition and diversity plans with investors

- Devise a plan to address or consider board diversity in the context of recruiting

- Consider implementing an ESG strategy that consists of routine disclosures on a number of areas highlighted by the Sustainability Accounting Standards Board (SASB)

For additional information on how to address diversity as part of a broader ESG strategy, contact our team today. We have helped our clients publish Corporate Responsibility Reports for investors, and we would be happy to support and guide you through this process as well.

Caroline Paul, Principal

Leave a Reply