Positioning Your Company for Success Post SPAC or Reverse Merger

When a company executes a reverse merger and/or becomes public via a Special Purpose Acquisition Company (SPAC) transaction, the newly public company will encounter investor relations challenges that differ from those of a traditional IPO. In Part II of our series, we will cover key steps to take in order to properly position a company after completing a reverse merger or De-SPACing.

Research Coverage During a Reverse Merger or SPAC

Traditional IPOs typically attract multiple banks, the syndicate, or financial advisors, to help facilitate the capital raising process. The syndicate performs customary due diligence prior to executing the underwriting process to bring the company public. Typically, sell-side equity research analysts work in parallel with the investment bankers during the due diligence phase and serve as an educational resource for the investment community during the underwriting period. Following a successful IPO, a trading market is established for the equity, and sell-side research analysts from the syndicate may launch equity research coverage. Sell-side equity research coverage plays an important role in increasing awareness of a newly public company.

When a company goes public through a SPAC merger, there are fewer financial advisors involved in the transaction; typically, there is one financial advisor for each private company and SPAC, as well as one or two capital markets advisors. As a result, there are far fewer banks involved in the creation of the publicly traded equity. With fewer banks involved and more limited diligence performed, there is less knowledge of the company and ultimately a lower likelihood that other banks will be willing to launch research coverage.

In some instances of SPAC mergers, the private company will need to raise additional capital through a Private Investment in Public Equity (PIPE), concomitant with the closing of the merger. A PIPE financing is an ideal opportunity to attract placement agents who will perform due diligence and help the company raise additional capital. Having had the opportunity to perform due diligence and facilitate the PIPE, banks have an incentive to launch equity research coverage on the company.

Over the past two years, more blue-chip banks have entered the SPAC market and are allocating resources towards helping “blank check” companies. SPACs have an opportunity to garner research coverage depending on the sponsors that raised the capital. With the amount of capital being raised by SPACs, the sponsoring banks may provide coverage on the post-acquisition public company.

Consider a Follow-On

After completing a reverse merger or De-SPACing, the newly public company may not have any sell-side coverage. Analyst coverage is usually generated as a result of the potential relationship between the investment bank and the covered company. In the event that a newly formed company will need to raise capital, working to establish relationships with multiple banks is beneficial. When the time comes to raise equity, it will be advantageous for the company to have a diverse syndicate team. The equity capital raise will provide an opportunity for the company to attract new banks, who in turn, may look to provide research coverage following the “secondary” offering for the company.

If there is no need to raise additional capital or utilize advisory services of the banks, given their limited resources, research teams of the banking community will have higher priorities than providing coverage. In this case, it will be even more critical for the management team to build an active investor relations program. It will be incumbent upon the IR team to educate investors, build company awareness, communicate financial objectives, and help set expectations for investors.

Creating an IR Strategy

Any newly public company should be well informed as to whom the investment community will view as business- and/or investment-comparable companies. Investors will often identify peers in order to compare business performance and relative investment attractiveness. It is important for a company to articulate its business and financial strategy and establish long-term objectives so that the company is “investible” to institutional investors. Knowing which investment firms own comparable companies is also helpful for newly public companies.

The first stepping stone towards curating an investor base is establishing an investor targeting campaign. Whether or not there is analyst coverage of a company, creating a targeted investor outreach campaign to get in front of investors is critical. Identifying the mix of investors that management would like to have and pursuing that mix is at the core of an IR strategy.

In the post-COVID world, engaging in non-deal roadshows can be an effective way to attract the attention of investors who are active in the industry. Virtual non-deal roadshows are an efficient way to provide investors with the opportunity to get a deeper understanding of the business operations and strategy. It is important to select the appropriate institutions to connect with during an NDR as management’s time is a limited resource. If there is no direct line to corporate access teams at banks, the company will need to set up their own roadshows.

Partner with the Right Investor Relations Firm

Oftentimes, newly public companies have difficulty navigating the investor relations juggernaut and are faced with a variety of options, including hiring an in-house team, outsourcing to an IR firm, or a combination of the two. Partnering with the right IR firm is a crucial decision that can influence a company’s strategy as a public company. IR firms help management navigate capital markets, develop corporate communications, aid strategic decisions and more. In today’s world, companies require more from their IR firm than drafting press releases and updating corporate presentations. A valued IR partner must be able to attract institutional interest to the company, help management build credibility, provide insight on corporate strategy, and develop strong messaging from a position of success.

The Gilmartin Group Approach

At Gilmartin Group, we recognize that no two companies are alike, and we tailor our work-scope for the unique needs and objectives of our clients. We build customized investor relations programs for emerging growth companies, large caps or micro-caps while acting as an outside strategic consultant. Whether the objective is helping private companies navigate Wall Street, raising capital, enhancing strategy or creating communications programs, Gilmartin’s team comes from backgrounds in Equity Research, Investment Banking and Equity Capital Markets that can create durable shareholder value.

We partner with our clients to evaluate and refine the key elements for a successful corporate strategy and to prioritize corporate resources with the goal of maximizing value for clients. We help our clients convey their story and investment proposition in a transparent, credible, and consistent way to the investment community and potential business partners.

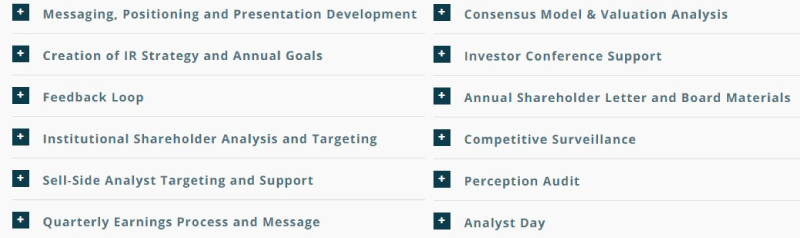

Business strategy and support activities include:

If you have recently De-SPACed or would like more information on implementing an investor relations strategy for an upcoming reverse merger or SPAC transaction, contact us today.

David Deuchler, Managing Director and Collin Beloin, Associate

Leave a Reply