Should Employees be Allowed to Sell Shares on the First Day of Trading?

Airbnb’s IPO Pop: Auction Transparency, Public Market Appetite & Equity Compensation

The first day of trading, when a newly minted public company begins to trade on the exchange, is a day marked with excitement and accomplishment. It is a day of celebration, as it denotes the successful completion of a capital raise and the potential for future value creation in the open market. Yet, when the stock price rises more than 25% above its IPO price, with company employees allowed to sell shares against this strength, does the situation call for merriment or concern?

In days of old, investment banks played the lead role in the pricing of IPO shares, balancing demand, mainly from long term investors, in the allocation of shares to issue. This process, part science and part art, at its very core aims at pricing discipline. The goal is for the efficient and effective matching of supply and demand such that both buyer and seller come away from the transaction satisfied with the amount paid for the value received. With the book filled and closed, attention turns to the first day of trade, as the public market helps validate the merits of the IPO transaction. When the IPO pop lands at around 20% – 25% of the IPO price, the transaction is generally deemed reasonable. The IPO was priced such that investors received a reasonable discount for shares purchased on assumed investment risk, and the company maximized on the amount of capital raised.

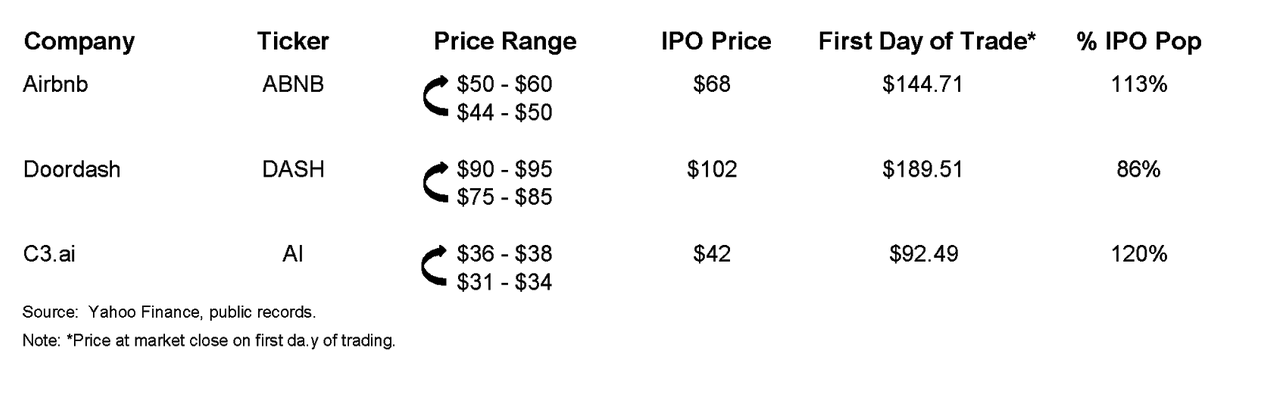

Last week, however, was witness to three new public technology companies, Airbnb, Doordash, and C3.ai, whose stock price at the first day of trade came in well above its IPO price, with gains over 85%. Despite an increase in IPO pricing range and the use of a hybrid auction process by two of the three companies, this better reflects positive investor interest.

While these marked IPO pops are rare, what draws further attention is the relative novelty of how Airbnb employees were allowed to sell 16.8 million shares beginning the first day of trading and, to a lesser extent, Airbnb’s use of the hybrid auction process. This is a departure from Doordash and C3.ai, who did not allow employees to sell shares. Furthermore,C3.ai used the traditional IPO bid and allocation model. Early into trading, with the stocks still finding their footing, we note that while all three companies continue to trade above their IPO price, C3.ai share prices remain above its IPO pop, while Airbnb and Doordash prices have eased from its first day of trade high.

Significant IPO pops beg the question: did the company leave money on the table? Do hybrid auction processes work? Did investors get too much of a discount? Did the bankers fail to secure a reasonable price? Or, were the number of shares freely traded post-IPO limited, driving relatively large movements in share prices on high demand?

Significant IPO pops beg the question: did the company leave money on the table? Do hybrid auction processes work? Did investors get too much of a discount? Did the bankers fail to secure a reasonable price? Or, were the number of shares freely traded post-IPO limited, driving relatively large movements in share prices on high demand?

All things considered, it appears IPO pops reflect some mismatch in demand vs. the initial shortage of stocks offered in the IPO, which results in a limited number of shares currently available for trade in the secondary market. This scarcity value, in today’s robust US – and global central bank fueled – market liquidity, including appetite from the retail investment community for growth stocks, appears to contribute to notable share price gains.

In a review of their respective prospectus, by our calculation, around 9% of Airbnb’s outstanding shares became available for trade in the open market following its IPO. This compares to approximately 10% and 20% of Doordash and C3.ai shares, respectively. Of these three companies, Airbnb holds the largest footprint given its global hosting business, which was posited to attract stock participation from an international retail and consumer audience. By comparison, Doordash’s business model has a US retail and consumer appeal, while C3.ai is notable in enterprise artificial intelligence software.

Given demand dynamics, including Airbnb and Doordash’s appeal to a wide audience, their use of the hybrid auction process to determine the IPO price is noted. Given the transparency, the process aims at maximizing capital raise, as well as measured bids, pricing, and long term investor base selection, following rigorous due diligence and valuation analysis by all parties. What the hybrid auction process does not fully consider nor predict, however, is the impact of aftermarket support, retail investors, and limited secondary market supply.

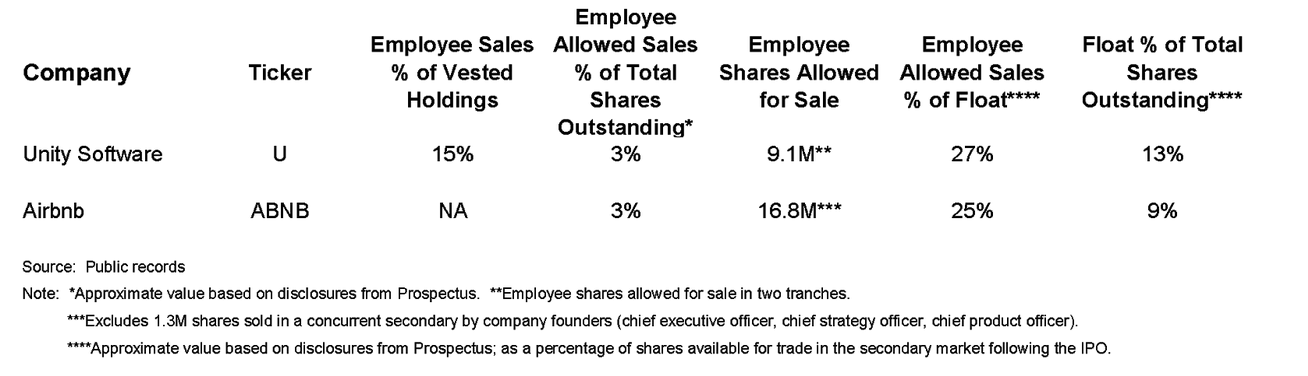

Allowing employees to sell shares in the first day of trade is relatively new and uncommon. Prior to Airbnb’s December 2020 IPO, Unity Software, a leading video gaming software developer, allowed employees to sell shares in their September 2020 IPO. Compared to Airbnb’s 16.8 million employee shares, Unity allowed 9.1 million employee shares to be sold.

Typically, employees and other company insiders are not allowed to sell shares after the IPO for a lockup period of 180 days. The lockup is designed to help stabilize share prices by preventing an influx of shares in the secondary market in the short term. While lockup periods can be shortened, allowing employees to sell shares on the first trading day after the IPO prices is generally prohibited.

Company shares granted to employees – directly or through an option plan – is a form of equity compensation. It is also aimed at retaining, incentivizing, and recruiting talent. In allowing its employees to sell 15% of vested shares on day one, Unity wanted its employees to participate in the IPO. For Airbnb, allowing employees to sell shares on its first trading day appears to embody equity compensation in its many forms, as it facilitated the cashing in of company stock received as part of compensation packages. Both with a global presence, Unity has 3,700 employees across 17 countries, while Airbnb hosts in over 200 countries and has offices in 24 cities with 2,390 employees internationally.

A balancing act, it may be that an overriding question in allowing employees to sell shares on the first day of trade is whether the additional supply destabilizes the secondary market such that confidence in a company’s future prospects or other fundamental or technical factors are undermined. For Airbnb, it appears the low number of shares available to trade after the IPO is aided by additional shares coming into the market from employee sale of shares, improving overall stock liquidity. This is in the face of potential stock trading interest from a global retail and consumer audience, given growth expectations in the company’s international hosting business.

To date, Airbnb’s IPO selling strategy appears to be holding. Early into Airbnb’s first day of trade, CNBC reported ABNB with the most active retail trading, with 47K buy vs. 1K sell orders. And while Airbnb’s robust 113% IPO pop has eased somewhat in recent trading days, the stock continues to trade above pricing. In a similar trend, Unity’s shares continue to trade above its IPO price and, on a more modest 31% IPO pop, continues to post returns ahead of its first day of trade.

Source: CNBC, Fidelity.

So should employees be allowed to sell shares on the company’s first day of trading? An uncommon practice, it appears the need to cash in on equity compensation may be balanced against the risk of destabilizing share prices in the secondary market. Factors to evaluate include the potential impact on company fundamentals and technical trading considerations.

Turning the page, is this selling strategy – in part or in whole – transferable? Can it be adopted by other growth companies, such as those in the healthcare sector? With the jury out, we note that the process has been laid and the path forged, all while strong comps – ABNB and U – maintain lead. We would not be surprised by IPO pipeline candidates evaluating this strategy to include healthcare companies driving rapid growth, as they challenge current norms with innovation, novel technologies, proprietary capabilities, unique business models, differentiation, or other competitive advantages.

To learn more about Gilmartin and how we strategically partner with our clients, contact our team today.

Vivian Cervantes, Managing Director

__________

Leave a Reply