Twelve months ago, society as we knew it changed forever at the hands of the COVID-19 pandemic. As a result of this increased volatility and certain negative impact on health care systems and the global economy, public company executives had no choice but to withdraw 2020 financial guidance. This led investors to ask tough questions around underlying business trends on what felt like shorter and shorter time horizons. Under “normal” circumstances, management teams would never dream of providing this level of detail and transparency, as it ultimately introduced risk that could be avoided by focusing on the intermediate to long-term trends. Interestingly, management teams who skillfully updated investors on monthly (and sometimes weekly) business trends were able to enhance their credibility by delivering on what they said. Given this backdrop and declining COVID-19 infection rates, one of the biggest questions heading into Q4 ’20 earnings season was whether or not small/mid-cap med-tech companies would issue full year 2021 guidance. At the start of earnings, everyone had an opinion on what companies should or should not do, but with Q4’20 earnings behind us, some interesting themes have emerged.

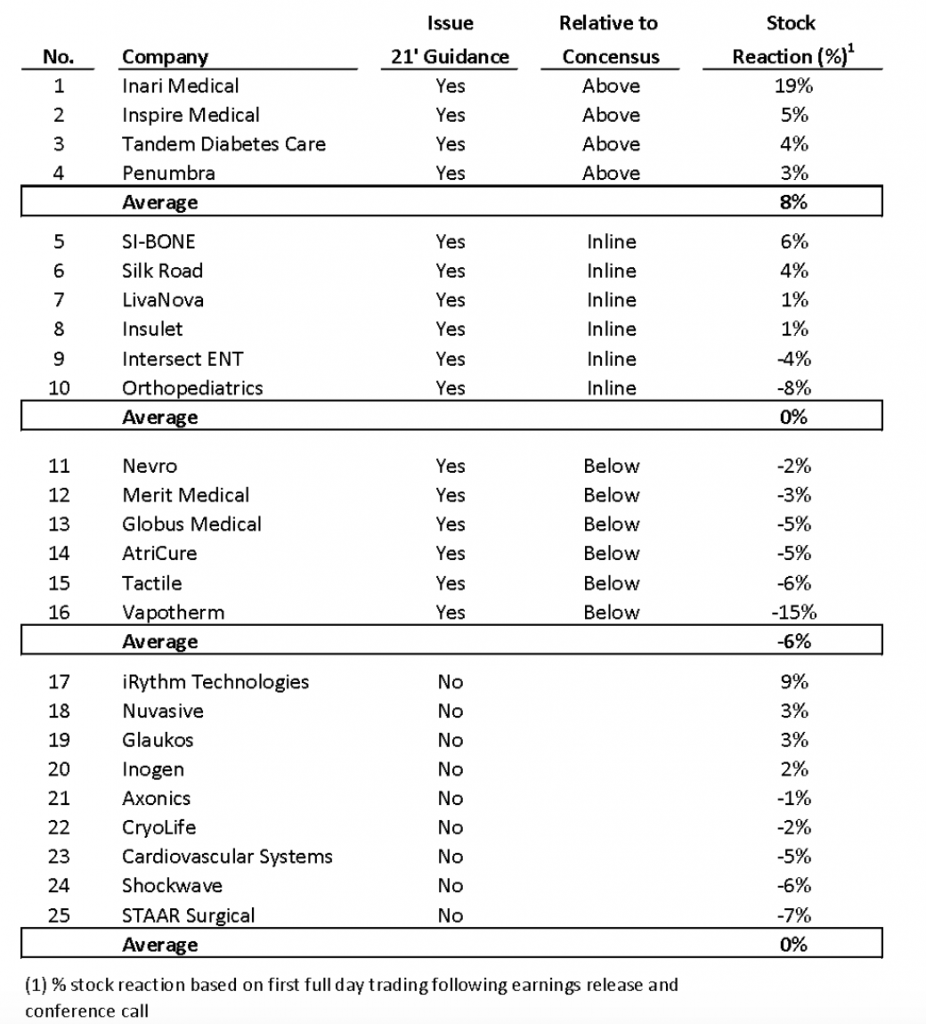

As detailed in Exhibit 1 (see below), 25 of the high-growth med-tech companies have reported Q4 ’20 results, with 16 issuing full year 2021 revenue guidance. Within this group, 4 issued guidance above consensus, 6 were roughly in-line with expectations, and 6 were below. Not surprisingly, companies who guided above consensus estimates saw their shares rise roughly 4% (excluding Inari), while those who came in below saw shares decline roughly mid-single digits as a percent. What is more interesting, but also not surprising, is the variability in stock prices of companies who did not issue guidance (ranging from down 7% to up 9%). Realizing this is a simple analysis and that each company is uniquely impacted by the COVID-19 pandemic, the results are still noteworthy.

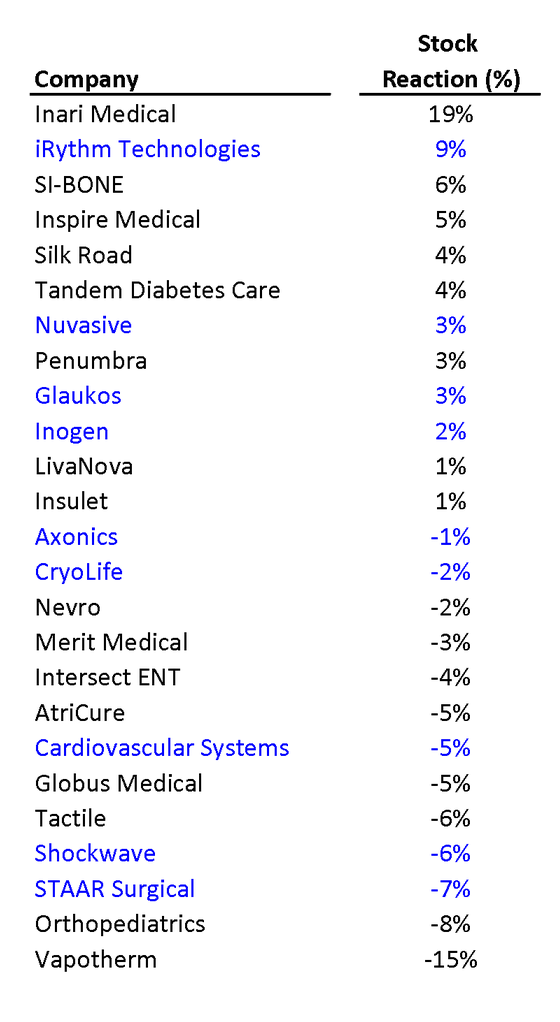

More specifically, if you combine all 25 companies, those who did not issue guidance are scattered evenly throughout the broader group – Exhibit 2 (see below). The point being that companies who issued guidance are not necessarily being rewarded for it at this point. While guidance allows management teams to put a stake in the ground for the year, investors know they cannot rely solely on management’s guidance at this stage in the recovery, given macro uncertainty and idiosyncratic risk at the company level.

So, what is right and what is wrong? While we like to believe there are heuristic shortcuts when presented with two options, as is the case in all facets of life, decisions are not made in a vacuum. When presented with the option of issuing guidance, it is not IF you do it but HOW you do it. Specifically, the logic and confidence at which you deliver a message is sometimes more important than the message itself.

What’s next? Since Q1’21 negative trends are likely fully priced in, investors will be keenly focused on: 1) what the COVID recover looks like in Q2’21 and if the backlog recapture is as robust as it was in Q3’20 and 2) what the back half of 2021 looks like with limited COVID headwinds. In less than 50 days, this is the communication challenge that management teams will need to grapple with to properly maintain expectations.

The team at Gilmartin is experienced in helping companies deliver compelling messages. Contact us today for help crafting your next public message.

Exhibit 1

Exhibit 2

Matt Bacso, Principal

Leave a Reply