The past few years have been ones of immense strength and record activity for venture capital (VC). Following a monstrous and record-setting 2021, the first half of 2022 has been different of sorts. VC has not been sheltered from the barrage of uncertainty felt in broader markets due to macro concerns. The private market has begun to show signs of weakness despite many data points remaining historically high. As we enter the second half of the year, it is important to review how the landscape has changed over the past six months.

Mid-Year 2022 Review: Venture Capital

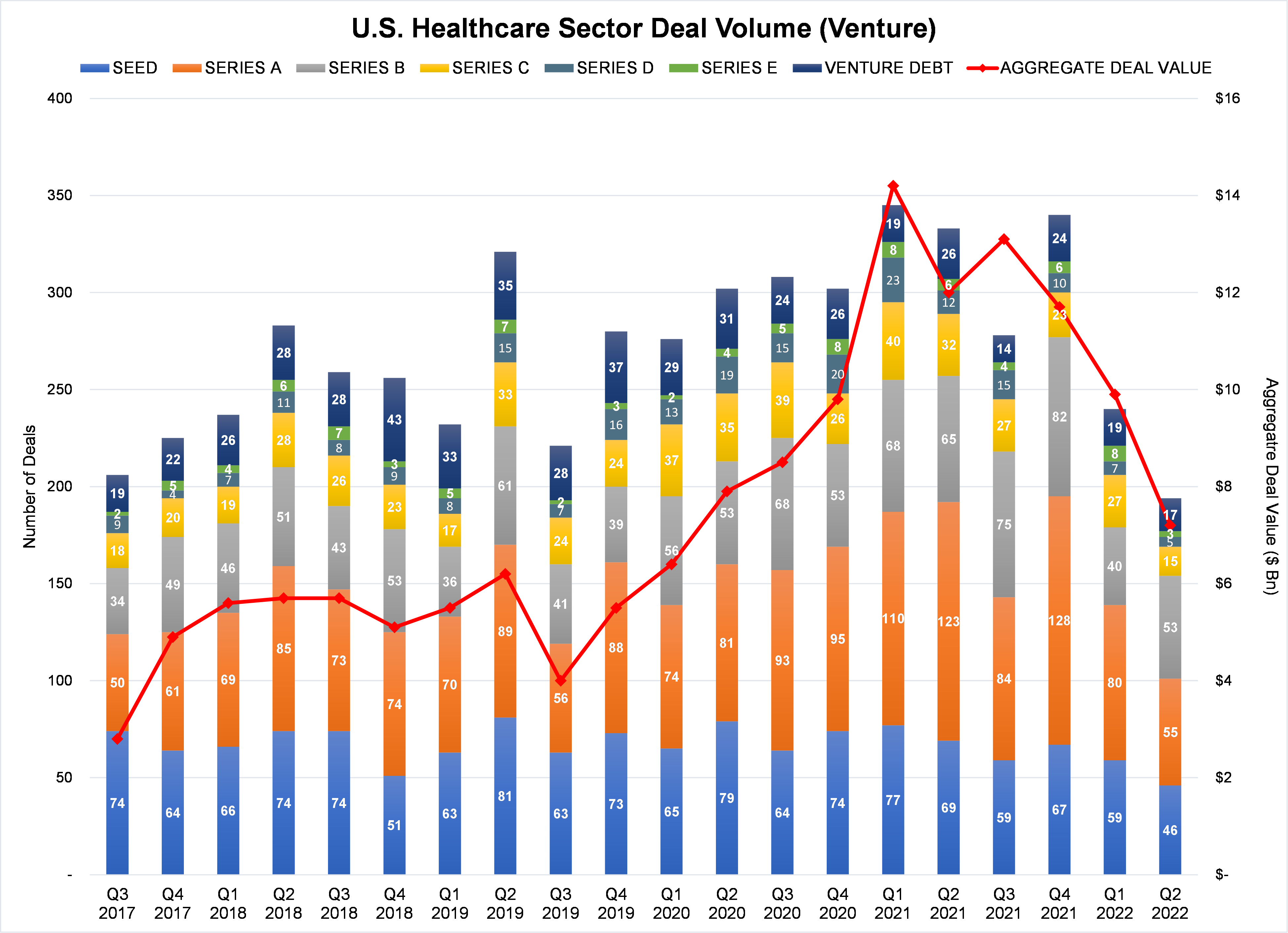

Deal Volume Stumbles

The onslaught of adverse economic headlines—inflation, rising interest rates, geopolitical turmoil, etc.—has contributed to the surge in volatility and slowdown in VC deals in 2022. During the first half of the year, global venture deal volume and average deal size (Seed through Series E) declined by ~6% YoY and ~12% YoY, respectively. While volume continued to grow during Q1 (albeit at a considerably slower pace), Q2 marked an inflection point as volume experienced a significant pullback, falling ~17% YoY.

U.S. Healthcare deal volume and average deal size (Seed though Series E) during the first half of the year declined ~37% YoY and ~0.5% YoY, respectively. The outsized pullback in volume has shown no signs of abating as volume in Q2 fell ~42% YoY (vs. -32% in 1Q22) and ~20% sequentially (vs. -30% in 1Q22). The weakness in volume has also been widespread, spanning across both early stage and later stage deals. Average deal size, however, has been relatively consistent ($42.7M in 1H2022 vs. $42.9M in 1H2021), but current data indicates that it may be trending lower moving into Q3.

Source: Preqin (as of July 2022)

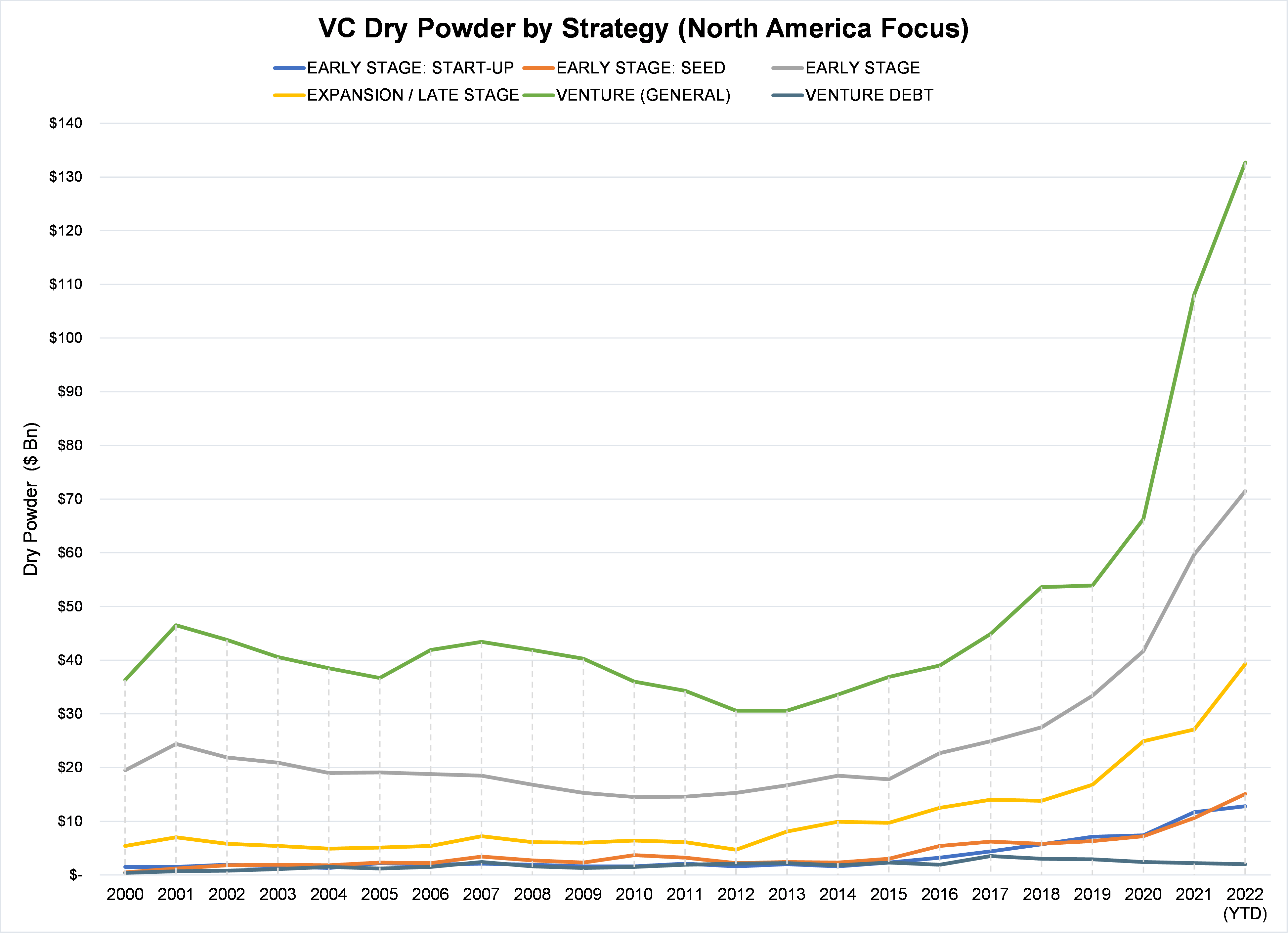

The Silver Lining: An Unprecedented Level of Dry Powder

Although deal activity has cooled, VC has continued to attract capital this year despite negative market volatility. Globally, VC firms have raised more than $100 billion through the first half of the year, down ~10% YoY but still elevated compared to pre-pandemic levels (average of ~$75B in the 1H from 2017-2019). The influx of capital and reduced level of deal activity has led to unprecedented amounts of dry powder waiting to be deployed. As of June 2022, VC dry powder globally was more than $500 billion, which is more than double the amount exiting 2019.

Preqin defines “dry powder” as the amount of capital that has been committed to funds minus the amount that has been called by general partners for investments.

U.S.-based VC firms have also fared slightly better coming off the launch ramp of 2021. During the first half of the year, U.S. VC firms raised ~$79 billion, down only 0.2% YoY. As of June 2022, U.S. VC firms had more than $280B in dry powder waiting to be deployed. This marks a record high as investors continue to sit on the sidelines.

Source: Preqin (as of July 2022)

What can we expect for the rest of the year?

It remains to be seen whether the drop in activity marks an adjustment from 2021’s record-breaking venture activity or the beginning of a more sustained downturn. Economic uncertainty due to the inflation, rising rates, supply-chain problems, and lingering COVID-related headwinds may continue to impact VC and public markets. On the other hand, record-setting amounts of dry powder have been amassed by VC funds and may continue to be deployed as investors gain more confidence and clarity.

For a company looking to raise capital during this turbulent time, it is important that you continue to meet with potential investors. Although there is a heightened sense of scrutiny with new investments, the relationship building process is as important as ever. VC firms are continuing to explore investments and meet with management teams given the seismic amount of capital on the sidelines.

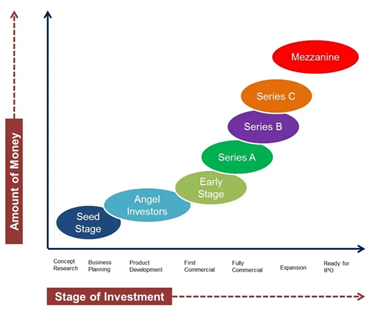

Recap: Natural Progression of Venture Fundraising

In our previous dive into the basics of venture capital (VC) and private equity (PE), we wrote about the general structure and process of how both VC and PE firms invest. Here we take a deeper look into the natural progression of how the venture fundraising process works.

There are five key stages of venture capital, starting from the seed round and ending with the mezzanine/crossover round. As a company develops and matures, each succeeding fundraising round represents a milestone for a company. Each round, investors will evaluate the merits of a company and how successful it has been in achieving its targeted goals. The amount of money a company can demand usually also increases as a company begins to reduce risk. Here’s an overview of each major round during the venture fundraising process.

1. Seed Funding

- Seed funding is the first “official” equity funding stage.

- Seed funding is the vehicle for a company to continue the progress made in the pre-seed stage by iterating on an idea or minimally viable product/service using funds from accredited investors.

- Investors may continue to be owners and/or family and friends, but angel investors, incubators, and accelerators may also participate.

2. Series A

- Series A funding revolves around a company’s revenue growth (i.e., proof of concept). At this stage, management teams will have to figure out how the company’s products and/or service will appeal to the targeted market.

- Mostly, funding from this round helps a company conduct extensive market research, pay employees, launch the product/service, and develop a marketing strategy.

- Investors involved come from more traditional and well-known VCs.

- By this stage, it is also common for investors to take part in a somewhat more political process. Commonly, a single investor or a group of a few investors may serve as the lead in the round. Once a company has secured a lead, it may be easier to attract additional investors as well.

3. Series B

- Series B funding is about expansion, taking the company to the next level, past the development stage.

- Series B funding becomes possible only when a company proves its market viability and is ready to expand on growth paths that have shown initial success.

- Typically, before Series B funding rounds occurs, the company has to have shown strong achievements after its Series A round. Therefore, Series B is the ammunition for growth with a larger investment round.

- Funding from this round is mostly used for business development, sales, advertising, technology, and talent acquisition. These investments provide the foundation for expanding market reach and meeting investor heightened levels of demand.

- Investors involved continue to be mostly VCs.

- Series B investors include many of the same participants in previous rounds.

- However, a Series B round also opens the door to a new wave of additional investors (e.g., VCs specializing in later-stage investing).

4. Series C

- Series C funding centers on long-term growth, focusing on a company that has already proven its business model but needs more capital for expansion.

- The proceeds from this financing round are most commonly used for entering new markets, research and development, or acquisitions of other companies.

- Although not formally the last stage of the funding lifecycle, most companies will end their external equity fundraising with a Series C round.

- Many investors from previous financing rounds tend to participate, but this round of financing often attracts new investors as well.

- Unlike the previous stages of financing in which most investors are VCs and angel investors, large financial institutions such as investment banks, hedge funds, and PE firms will begin to participate.

- Participation from a wider range of investors is due to proven strengths of the business model and opportunity, and the perception that the company has been materially de-risked.

5. Mezzanine/Crossover

- The mezzanine and/or crossover round is the final stage before a company goes public, typically occurring within 12 months prior to an IPO.

- Mezzanine financing is typically known as bridge financing because it finances the growth of expanding companies prior to an IPO.

- A crossover round is traditionally defined as a venture financing in which there is significant participation from investors that typically buy into publicly traded companies or IPOs, usually within the 12 months prior to their IPO.

- Investors from previous financing rounds may continue to participate, but interest is more widely spread as investors are looking to benefit from the lower valuation than the IPO valuation.

Gilmartin Group partners with many healthcare innovators, both public and private, to build nuanced communications strategies and develop sustainable messaging that sets companies up to build credibility over time while clearly conveying the differentiated value they provide. To learn more about Gilmartin and how we strategically partner with our clients, contact our team today.

Stephen Yeung, Associate

Leave a Reply