Pre-Org Meeting IPO Prep: S-1 Drafting

The S-1 is comprised of business and financial information designed to inform prospective investors and outline all material business risks. It offers an in-depth, first look at a private company, and analysts and portfolio managers often comb through the public document carefully when considering an investment.

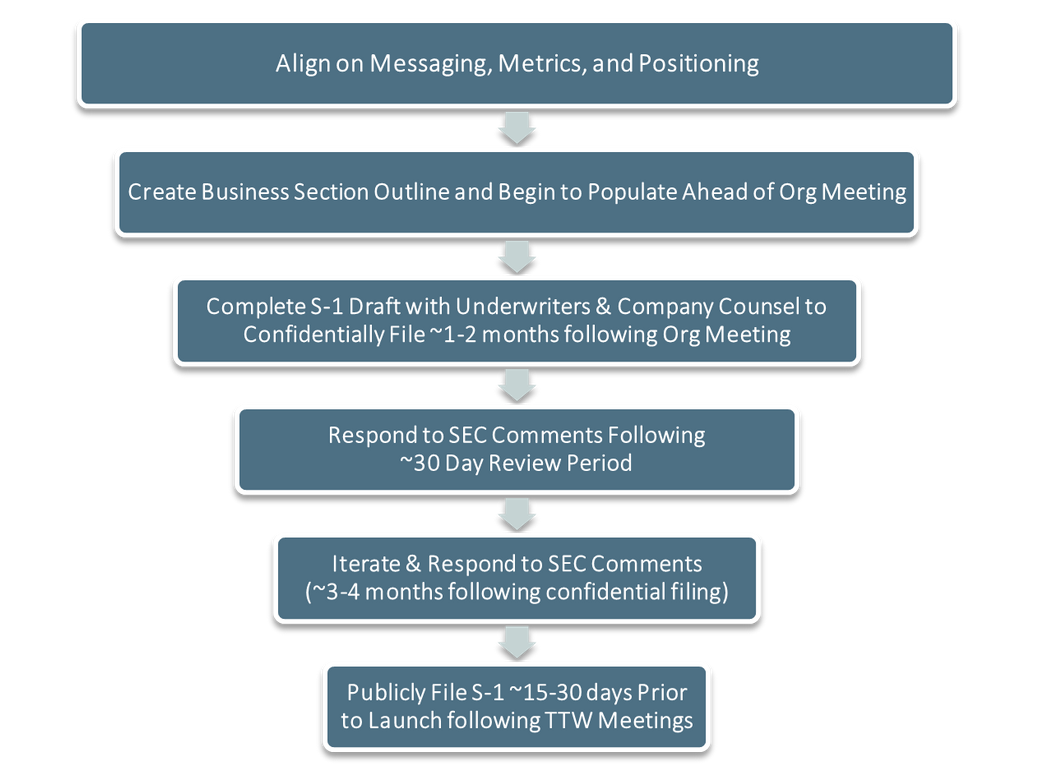

General S-1 Drafting & Filing Execution Timeline:

Business Section Overview

Generally, the business section is where you will have the most latitude to tell your story and make the case to prospective investors regarding why they should make an investment in the IPO. It’s important to remember that the S-1 serves two purposes: to market your IPO and to disclose risks and satisfy other legal requirements. As a management team, you should generally focus on including what you’d like to say. Leave it to your underwriter and legal teams to guide you in satiating legal requirements and mitigating risk. As a reminder, everything included in your roadshow deck must be included in the S-1, and every data point included in both must be well-sourced and factually supported.

Outline/Structure

In terms of content, most S-1 business sections will follow the same general outline, with some nuance depending on management’s preference and investment thesis specifics. It’s also worth noting that much of the business section will be repetitive by nature.

The time it takes to turn an outline into a more thoughtful draft will vary, but the iterative process typically takes about 1-2 months prior to the Org Meeting and another month or two following the Org Meeting. Leveraging your IR partners to coordinate the drafting process and “manage the master” can significantly mitigate the burden on your internal team.

Illustrative Guidelines for the Flow and Structure:

1. Overview – “The Box”

- Goal: This section is a comprehensive yet high-level overview of the entire business section where companies make their strongest case, in their own voice, on the attractiveness of the offering.

- Length: 4-6 paragraphs

- Topics:

- Mission/vision

- Brief product overview

- Market highlights/opportunity

- Growth/progress to date

2. Competitive Strengths

- Goal: This is effectively a more thorough version of the investment thesis slide found in the beginning of roadshow decks where the company highlights the most compelling components of the offering.

- Length: 4-6 bulleted (short) paragraphs, each formatted with a bolded highlight plus additional support copy

- Potential Topics:

- Technology

- Clinical validation

- Payor value

- Established reimbursement

- IP

- Management team

3. Growth Strategy

- Goal: This is effectively a summary of the drivers behind your success (answering the question why/how are we going to be successful?); may also include your commercial strategy, pipeline and short term/long term growth drivers

- Length: 4-6 bulleted (short) paragraphs, each formatted with a bolded highlight plus additional support copy

- Potential Topics:

- Strength of product

- Initial strategy

- Mid-term commercial strategy

- Longer term commercial and growth strategy

- Pipeline

- Market expansion

4. Market Opportunity

- Goal: To convey the size and scope of the addressable market(s) and how management is approaching it. How you discuss the opportunity should align with the commercial strategy.

- Length: Variable – typically 3-6 pages

- Topics:

- Unmet needs

- Existing alternatives/competition

- Limitations

- Addressable market

- Disease overview(s)

- Market segments

- TAM ($) – Theoretical vs Attainable

- Unmet needs

5. Product(s) Overview/Our Solution

- Goal: To demonstrate that you have the solution to address the unmet needs outlined previously and take share aggressively.

- Length: 3-6 pages, including images/graphics

- Topics:

- Procedure/technology overview

- Mechanism of Action (MoA)

- Advantages

- Patient

- Provider

- Payor

6. Clinical Data

- Goal: To provide a succinct and compelling overview of clinical data demonstrating the safety and efficacy of the product/solution.

- Length: 3-5 pages

- Topics:

- Overview

- Trial results

- Explanation of endpoints

- Data tables

- Comparative data sets

7. Reimbursement

- Goal: To demonstrate the current and expected status of reimbursement for the product/solution.

- Length: 2-6 paragraphs depending on level of nuance

- Topics:

- Covered lives

- Coding

- Payment

- Go forward strategy

8. Commercial/Growth Strategy (placement is variable, sometimes earlier)

- Goal: To convey what you’re doing to capitalize on market now and in the future. Consider modelling implications for how you outline your strategy.

- Length: 2-5 pages

- Topics:

- Sales and marketing strategy

- Salesforce expansion

- Clinical pipeline

- Product pipeline

9. Intellectual Property

- Goal: To explicitly state details relative to IP portfolio.

- Length: 2-4 paragraphs

- Topics:

- Patents by geography

- Issues/pending

10. Manufacturing & R&D

- Goal: To provide details around current and expected manufacturing strategy. To convey focus on specific product development.

- Length: 1-2 page

- Topics:

- Facilities

- Contract manufacturer relationships

- Quality management

- Supply chain

11. Government Regulation

- Goal: Provide boilerplate type details to satisfy disclosure requirements.

- Length: 1-2 pages

- Topics:

- FDA approval process/timeline

- Continuing regulation

- OUS regulatory authorities

- HIPAA, CMS, private payers, etc.

- Other relevant regulations

12. Additional Details

- Goal: To explicitly state factual details.

- Length: 1 paragraph per topi

- Topics:

- Employees

- Facilities

- Legal proceedings/ongoing litigation

Post Org Meeting Expectations

After your org meeting, your bookrunners will typically manage the remainder of the S-1 drafting process, scheduling a number of calls each week for the month or two following your org meeting–with the goal to complete and confidentially file the S-1 around 3-4 months prior to anticipated IPO pricing.

The SEC will typically provide comments to the confidentially filed Form S-1 in approximately 30 days. Corporate and underwriter counsel will work to address any issues and will coordinate with management and bankers to respond and amend the S-1 accordingly. This process continues until the SEC approves the S-1, typically after 1 to 2 rounds of comments, at which point the filing can “flip” to public and the IPO roadshow can commence. Typically, S-1s flip public 2-3 weeks prior to the roadshow.

Conclusion

In all, coming to your Org Meeting with a thoughtful first draft of the S-1 business section is time effective and allows your team to focus on other more pressing matters through the early stages of the IPO prep timeline. For more information on S-1 drafting or to learn more about Gilmartin and how we strategically partner with our clients, contact our team today.

Brian Johnston, Vice President

Leave a Reply