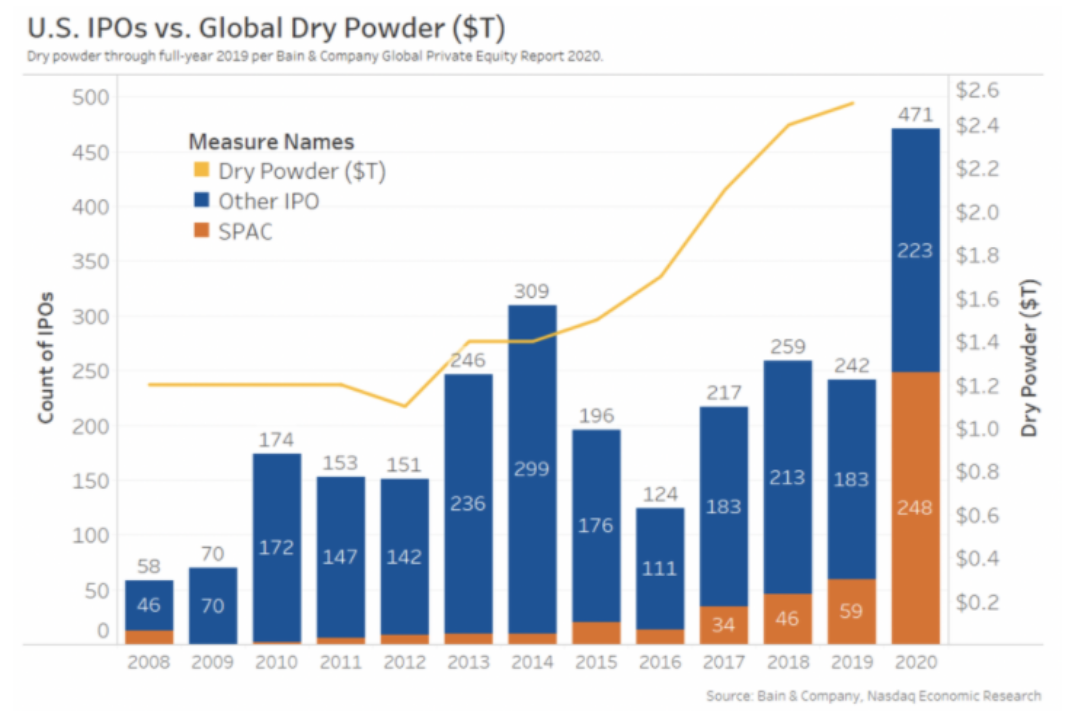

Given the prevalence of recent SPAC-sponsored public listings, the process of executing a successful SPAC combination may seem clearer than ever. Advantages of combining with an SPAC (Special Purpose Acquisition Company, or blank-check company) are now relatively well understood, including (1) efficient access to capital and (2) the potential to leverage your SPAC partner for strategic advice, industry expertise, investor relationships, and greater commercial visibility. Further, a growing list of precedent transactions provides a potential “model SPAC” framework to assess and deploy as challenges and questions on the path to public listing arise.

Ready, Set, SPAC?

Not (necessarily) so fast! There are multiple, varied approaches to accessing public markets via SPAC merger, and what works for one company is not necessarily the right strategy for another. As with any major corporate decision, there are material risks and benefits to acknowledge as you consider pursuing an SPAC combination. The advantages may well outweigh the risks, but your company’s challenges and opportunities are unique, driving the need for a tailored strategy.

Gilmartin Group is working with nearly one dozen healthcare companies in SPAC combination processes.

If your company is considering, or in the early stages of, public listing via SPAC merger, we highlight several considerations to help you (1) assess your company’s public market readiness; (2) communicate your story and objectives to employees, investors, and external stakeholders; and (3) map out logistics as you prepare to be publicly listed within a matter of months.

Our recommendations center on making a thoughtful decision to go public, creating a sincere, consistent, and well-supported message outlining your value proposition and objectives, and organizing processes such as timeline management, internal education, and external outreach in advance. When unexpected challenges arise, having a plan in place to address them will go a long way.

1. Assessing Your Company’s Public Market Readiness

The timeframe from definitive agreement (announcing mutual intentions between an operating company and SPAC to combine) to listing day often spans no more than a few months. As you evaluate your readiness to pursue an SPAC business combination, consider:

- The capacity, experience, and rigor of your internal FP&A team

- Questions to ask: Is our team prepared to build a detailed, quarterly financial forecast? Do we have a consistent process behind internal financial forecasting? How has our business performed relative to our internal model in recent quarters? Is our team prepared to offer a formal financial forecast to investors and sell-side research analysts? Who is leading our FP&A team (do we have a suitable CFO)?

- SPAC partner value-add

- Questions to ask: How sophisticated is the SPAC management team and Sponsor with public equity investors? What is the relevant experience, relationships, and/or industry expertise that the SPAC partner brings to our company?

- Advisory and leadership

- Questions to ask: Is our executive team complete? Do we have relationships with experts or advisors who can support our transition to a publicly traded entity, and/or would be additive to our Board of Directors? What characteristics, background, and range of experience will we prioritize in selecting Board of Directors members?

- SEC process readiness

- Questions to ask: Do we have materials to draft the necessary components of an S4 filing? Have we done proxy work ahead of the definitive agreement announcement?

- Number and caliber of banks involved in the transaction

- Questions to ask: Which banks do we want to bring on as financial advisor(s), capital markets advisor(s), and private placement agent(s) if the transaction will be supported by a PIPE offering?

- Preparation for equity research coverage

- Questions to ask: Have any Equity Research teams expressed interest in covering our company? Have we reached out to introduce ourselves to banks and their research teams? Have we expressed direct interest in having analyst coverage?

2. Communicating Your Story and Objectives

First impressions matter, but strategic investor and stakeholder communications go well beyond your initial pitch. Prepare a compelling, concise, and consistent message that will help investors, sell-side analysts, and other internal/external stakeholders understand the company’s value-add. We suggest outlining:

- Company mission

- Questions to ask: How can we convey our purpose in one concise statement? What are our near-term and long-term objectives? Are we messaging our mission consistently across customers/commercial relationships, employees/internal relationships, and investors/sell-side constituents, and other external relationships?

- TAM (total addressable market) characteristics

- Questions to ask: Is our market readily understood? Is it clearly defined? Who are our peers and/or competitors? What is our current level of market penetration, and what level of penetration are we assuming in our financial forecasts?

- Financial forecasts and supporting rationale

- Questions to ask: What are the key assumptions underpinning our model? What metrics and KPIs will we provide regularly? Are we confident that we can execute on our financial forecasts? What could a Bear Case (downside scenario) and Bull Case (upside scenario) look like, if those assumptions prove too aggressive or conservative?

- Diligence materials

- Questions to ask: Do we have a list of experts and KOLs (key opinion leaders) familiar with our product, whom we can connect to investors and sell-side research analysts? Do we have a packet of clinical/commercial/other materials that we can provide to help educate these parties?

3. Mapping Out Logistics

Every well-executed transaction relies on an organized calendar and a consistent decision process. Consider preparing:

- An integrated timeline or workstream tracking responsibilities and deadlines

- Questions to ask: What are the key responsibilities of the executive team, banks, legal counsel, FP&A team, investor relations, and public relations? What are our priorities from the point of LOI (letter of intent) through merger-close and beyond? How often will we meet to track progress?

- Internal communications

- Questions to ask: Are we prepared to communicate the rationale for, and implications of, our business combination agreement to employees? Do we have a prepared list of employee and shareholder FAQs to distribute upon definitive agreement announcement? Are we ready to host a series of internal Town Hall Meetings to educate employees about implications of going public, and/or explore other ways to maintain our culture, drive excitement, and “make a splash” with our news? How will we celebrate our first day of trading as a public company?

- Wall Street communications

- Questions to ask: Do we have a curated list of investors and sell-side research analysts for outreach? When are we scheduling meetings, and who is facilitating? How will we provide business or financial updates in the period between merger-announcement and transaction close? Are we prepared to host an investors’ email inbox? Do we have, or are we building, an investor website?

- Additional stakeholder communications

- Questions to ask: How will we message our intent to go public with customers/clients, researchers, advisors, Medical Advisory Board members, or other stakeholders who have contributed to our business?

Conclusion

No two SPAC processes are the same, and there are multiple, varied approaches to successfully accessing public markets through an SPAC business combination. The considerations here are just a sample of questions that we have helped our clients address. If you are interested in working with us or simply learning more about our approach, contact our team today.

Marissa Bych, Vice President

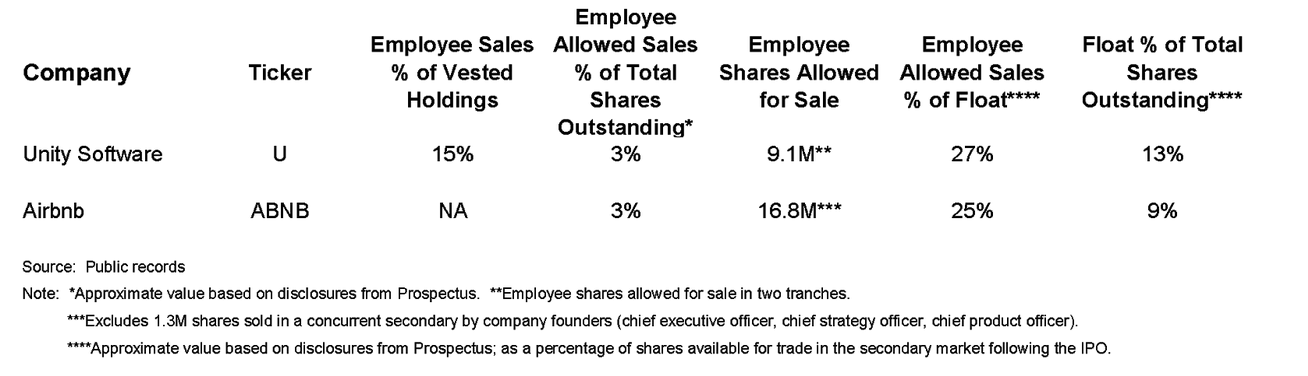

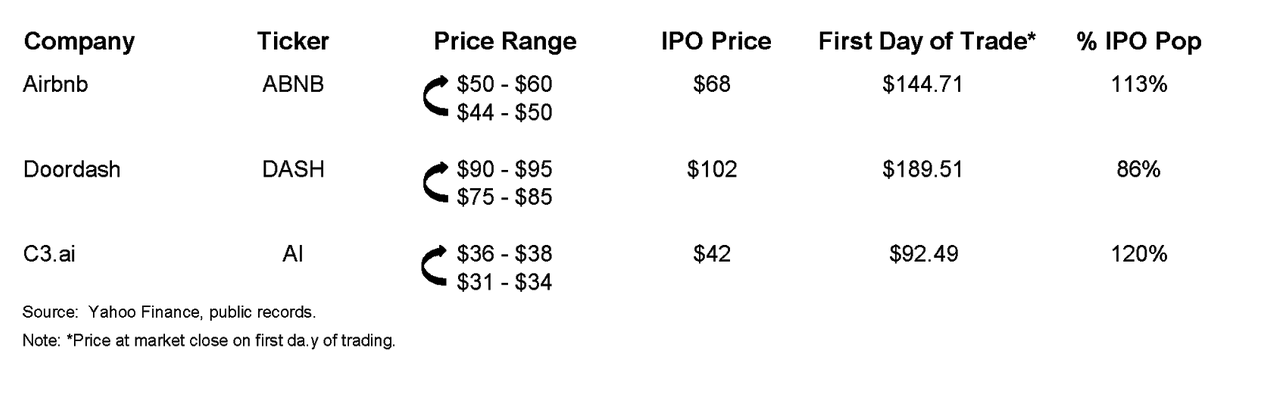

Significant IPO pops beg the question: did the company leave money on the table? Do hybrid auction processes work? Did investors get too much of a discount? Did the bankers fail to secure a reasonable price? Or, were the number of shares freely traded post-IPO limited, driving relatively large movements in share prices on high demand?

Significant IPO pops beg the question: did the company leave money on the table? Do hybrid auction processes work? Did investors get too much of a discount? Did the bankers fail to secure a reasonable price? Or, were the number of shares freely traded post-IPO limited, driving relatively large movements in share prices on high demand?